This intermediate course offers a review on who qualifies for the standard deduction, and what circumstances allow taxpayers to claim a higher standard deduction. You will also learn what an exemption is, (even though it has been suspended due to TCJA). Filing status is used to determine filing requirements, standard deduction, correct tax, and taxpayer’s eligibility for certain credits and deductions. If more than one filing status applies to the taxpayer, the tax professional should choose the one that lowers the amount of tax for the taxpayer.

At first glance, filing status seems simple to determine. After all, isn’t it basically whether a person is married, and how married couples want to file their returns? Despite how simple it may seem; it can quickly get complicated. For example, what do you do when more than one filing status applies to a taxpayer? Publication 17 and Publication 501 show us that the correct answer is to choose the status that lowers the amount of tax for the taxpayer the most. It is vital that tax professionals know the answers to questions like this and understand the details of each filing status so they can help their clients to the best of their ability. But don’t worry; this course will help you understand just that.

At the end of this course, the student will be able to do the following:

- Recognize how to determine the standard deduction.

- Understand who qualifies for a higher standard deduction.

- Explain the qualifying child test requirements.

- Identify the difference between a qualifying child and a qualifying relative.

- Describe the difference between custodial and noncustodial parents.

- List the five filing statuses.

- Recall the requirements for each filing status.

- Identify the types of income to determine support.

Field of Study: Federal Tax Law 2 Hours

Course Level: Basic

Prerequisite: None

Delivery Method: Self-Study

Self Study

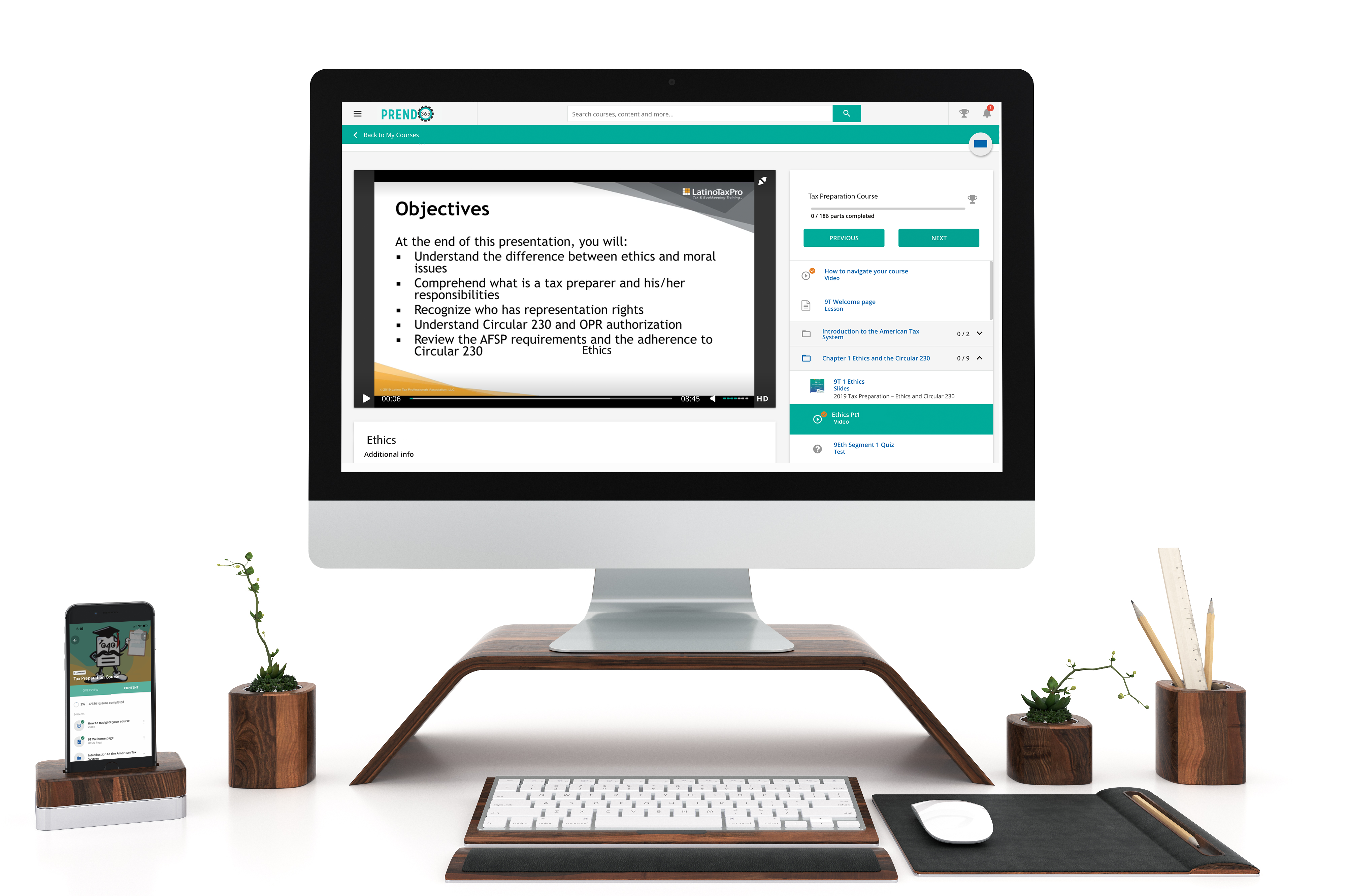

Learn at your own pace, read or watch the lessons, pass the exams.

Mobile Friendly

Learn on your phone, tablet, or computer.

Bilingual

All our courses are available in English y español.

Career Paths

No matter where you’re at in your career, we have courses for you.

Simple Learner Experiences

Prendo365 gives you access to your course anytime, anywhere, on desktop, tablet, or mobile device. You're able to easily navigate through your course and receive your certificate of completion.

Why choose us

Over 35+ years tax preparation experience

We know what tax preparers need to succeed in their office

7+ EA’s and tax preparers on staff

Our team does extensive research to ensure you receive the best education

Bilingual live support

Having technical issues? We're ready to help you get started and complete your course.