HOW WOULD YOU LIKE TO PREPARE AN EXTRA 700+ TAX RETURNS DURING TAX SEASON?

START YOUR TAX SCHOOLLET'S TALK ABOUT STARTING YOUR TAX SCHOOL!

Fill out the form below to book a call.

STARTING YOUR TAX SCHOOL IS A SMALL INVESTMENT

WITH HUGE BENEFITS.

Our Instructor Program is part of a complete Professional Training System that turns your office into a Training Center where you can train your way, recruit high-quality employees to grow your business, and reduce your stress!

Train-To-Hire

Offer CTEC, IRS, and NASBA approved Continuing Education to train your staff to your standards, generate revenue year-round, and attract high-quality employees.

Year-Round Revenue

By launching your tax school, you can buy courses at wholesale prices and resell them to students at a retail price that works for you.

Expand Your Tax Office

A tax school provides a steady revenue stream to help expand to multiple offices, each staffed by well-trained, entry-level tax professionals who have received top-tier instruction directly from you.

HERE'S WHAT IS INCLUDED IN YOUR INSTRUCTOR PROGRAM

WE CREATE THE TEACHING MATERIAL FOR YOU!

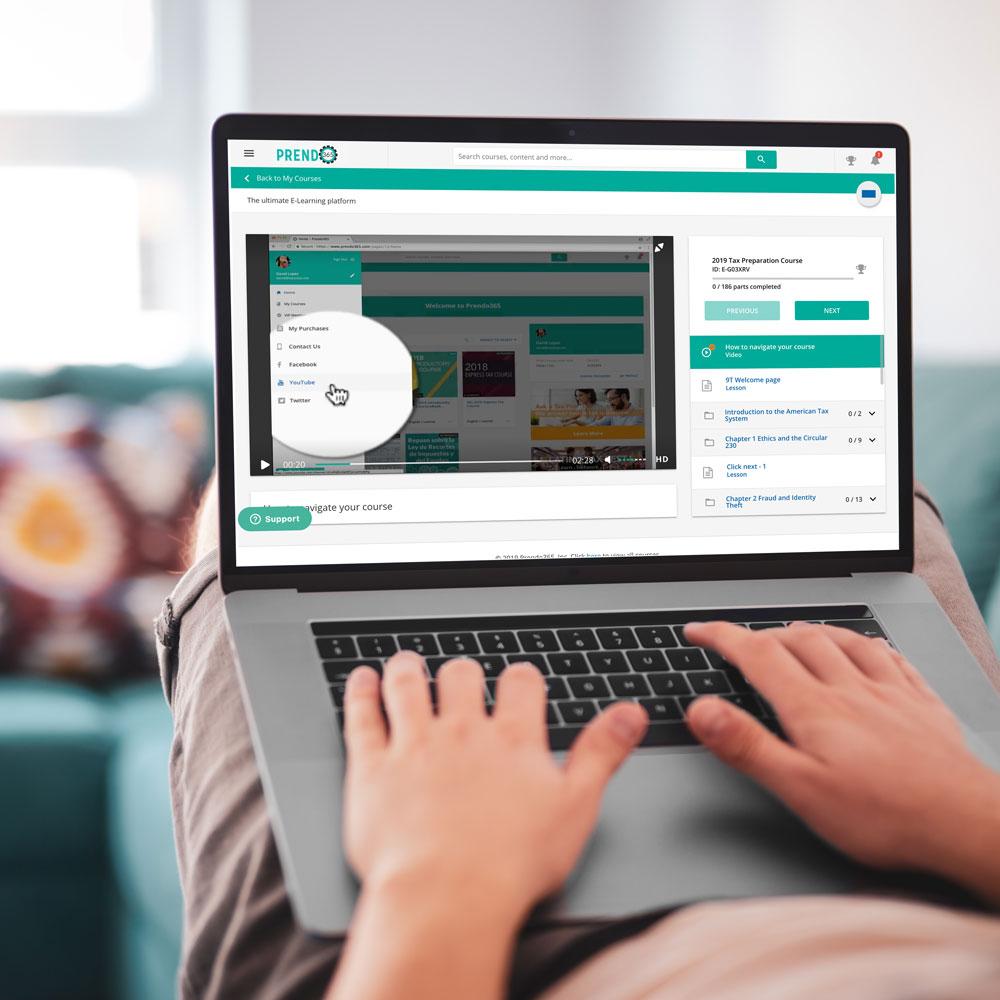

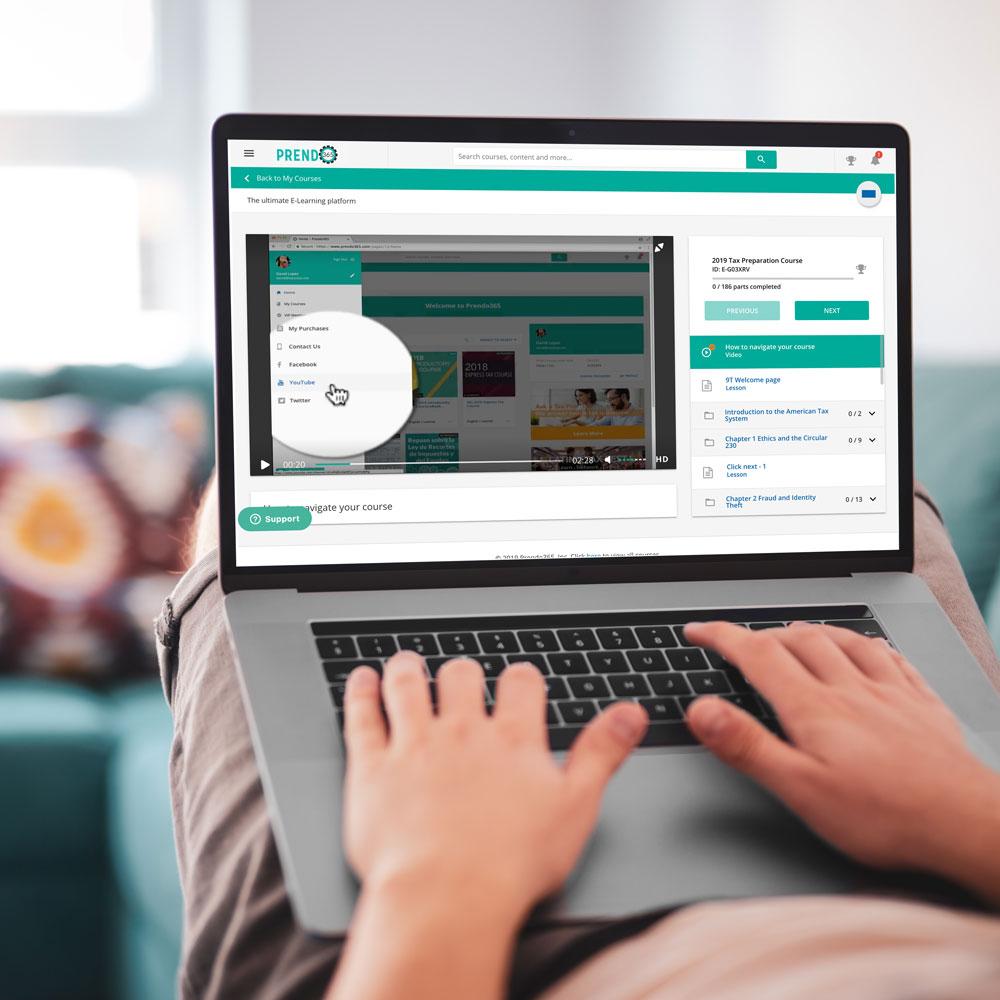

Instructor Dashboard

Our instructor dashboard simplifies class management by allowing you to enroll students, track progress, and download certificates in one place.

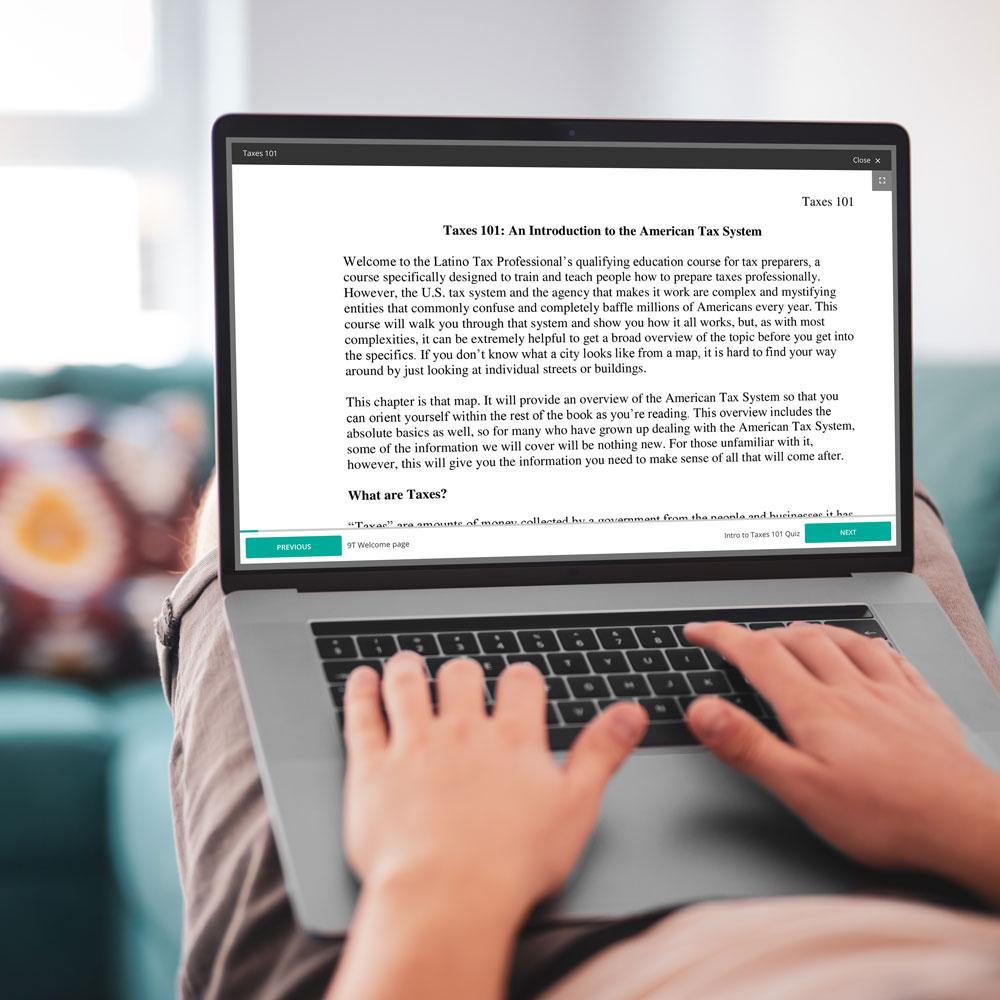

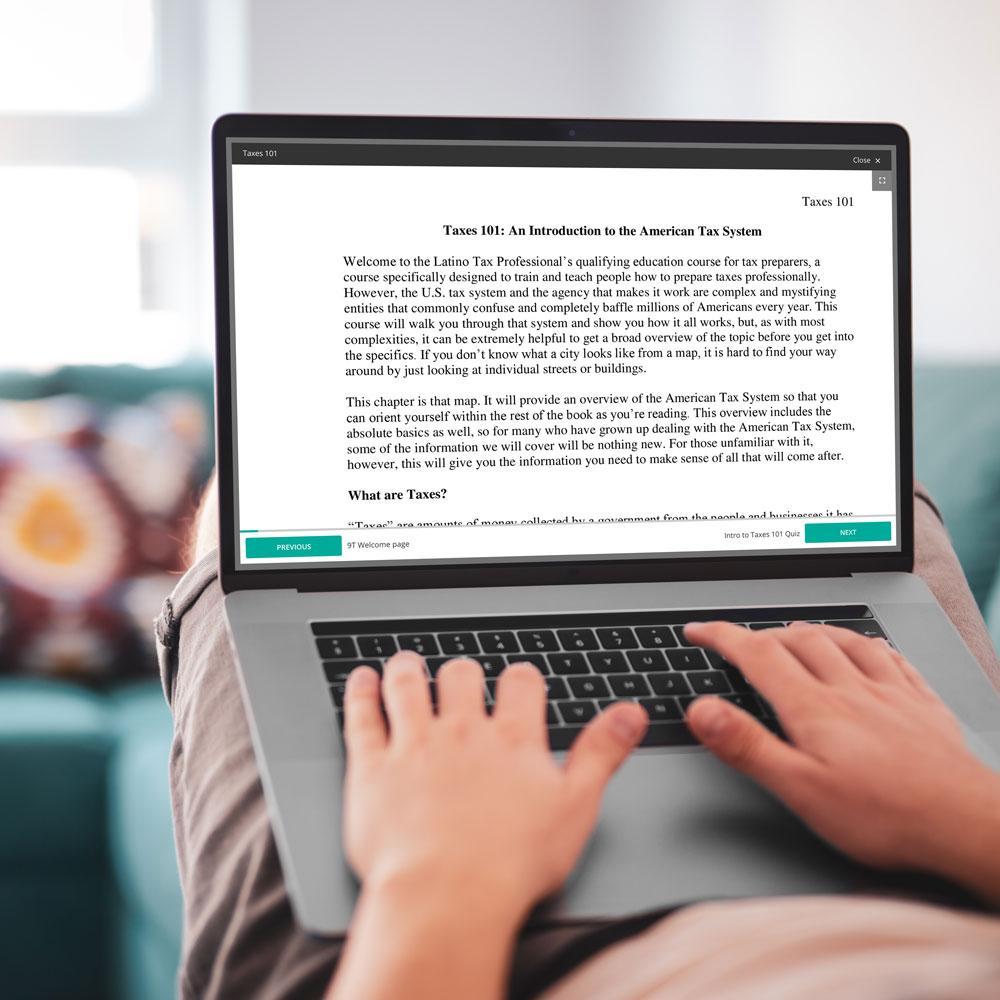

Teaching Material

Time is precious, and our program saves instructors over 200 hours of course development by providing ready-to-teach materials in English or Spanish, including PowerPoints, quizzes, practice tax returns, exams, and lecture guides.

Wholesale Pricing

Instructors are required to purchase a "Seat" at an additional cost for each student to provide course access and ensure credits are reported. With our 40% wholesale discount on self-study courses*, you can set your own pricing and maximize your profits!

Marketing Material

Our program simplifies marketing your tax school by providing ready-made posters (in English and Spanish) and inquiry cards.

Your contact information will also get placed on our instructor map to help students discover your local tax school!

* 40% off discount is only applicable to courses listed in the instructor reseller catalog, this does not include in-person or webinar courses. Contact us for details.

Choose Your Instructor Program

Instructor program includes current tax season educational powerpoints and 1 year of technical support.

Choose your language and state package below.

You also have an option to add physical textbooks to your package at an additional shipping cost.

California Tax Instructor Program

Federal Tax Instructor Program

Bilingual California Tax Instructor Program

Bilingual Federal Tax Instructor Program

Join our FREE biweekly meetings designed to guide new or renewing instructors through the year. Instructors can interact, share, learn, teach, and discuss different issues that arise while and when teaching basic and advance tax courses. Meetings will be held in English and Spanish!

Instructor Corner Schedule

English

• November 24 - #9: Do you want to add one more class to your schedule but not sure which one? Click here to register

• December 8 - #10: Recap on our Training Season. Click here to register

Español

• 1 de diciembre - #9: ¿Desea agregar una clase más a su horario, pero no está seguro de cuál? Haga clic aquí para registrarse

• 15 de diciembre - #10: Recapitulación de nuestra temporada de entrenamiento. Haga clic aquí para registrarse

Here are your next steps to get started after your onboarding call with your dedicated Success Representative.