Pick and choose your credits! This bundle will include 24 hours of Tax Law, 3 hours of federal tax updates, and 2 hours of ethics.

• Tax Updates (3U) (2025 updates Coming soon)

• Adjustments to Income (1T)

• Compiling Taxpayer Information (2T)

• Ethics and Preparer Penalties (2E)

• Electronic Filing (1T)

• Extensions & Amendments (1T)

• Filing Status, Dependents, and Deductions (2T)

• Income (4T)

• Itemized Deductions (2T)

• Other Taxes and Taxpayer Penalties (2T)

• Schedule C (2T)

• Schedule E and Capital Gains and Losses (2T)

• Schedule F and Depreciation (2T)

• Tax Credits and Payments (3T)

Self Study

Learn at your own pace, read or watch the lessons, pass the exams.

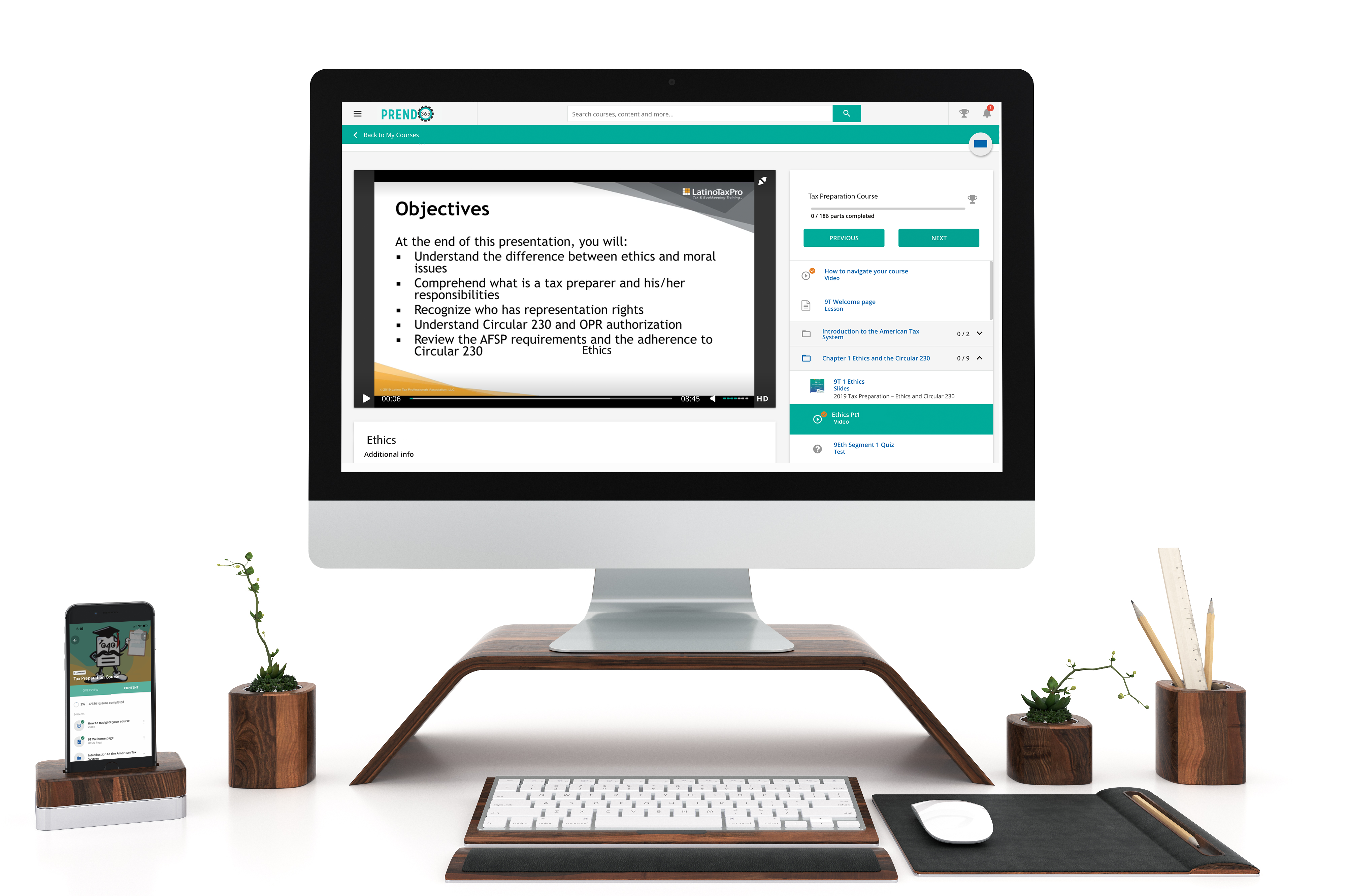

Mobile Friendly

Learn on your phone, tablet, or computer.

Bilingual

All our courses are available in English y español.

Career Paths

No matter where you’re at in your career, we have courses for you.

Simple Learner Experiences

Prendo365 gives you access to your course anytime, anywhere, on desktop, tablet, or mobile device. You're able to easily navigate through your course and receive your certificate of completion.

Why choose us

Over 35+ years tax preparation experience

We know what tax preparers need to succeed in their office

7+ EA’s and tax preparers on staff

Our team does extensive research to ensure you receive the best education

Bilingual live support

Having technical issues? We're ready to help you get started and complete your course.