This course contains both English and Spanish content.

Income received from the operation of a farm or from rental income from a farm is taxable. Farmers determine their taxable income from farming and related activities by using Schedule F. Profit or loss from farm income is first reported on Schedule F and then “flows” to Form 1040, Schedule 1, line 6. A farm could qualify to be a qualified joint venture (discussed in Schedule C chapter).

Depreciation is an annual deduction that allows taxpayers to recover the cost or other basis of their business or investment property over a specified number of years. Depreciation is an allowance for the wear and tear, decline, or uselessness of a property and begins when a taxpayer places property in service for use in a trade or business. The property ceases to be depreciable when the taxpayer has fully recovered the property’s cost or other basis or when the property has been retired from service, whichever comes first. Depreciation is reported on Form 4562.

Objectives

At the end of this lesson, the student will:

- Understand basic farm income

- Know when a taxpayer should file Schedule F

- Know when property cannot be depreciated

- Recognize when depreciation begins and ends

- Be able to identify which method of depreciation to use for property

Self Study

Learn at your own pace, read or watch the lessons, pass the exams.

Mobile Friendly

Learn on your phone, tablet, or computer.

Bilingual

All our courses are available in English y español.

Career Paths

No matter where you’re at in your career, we have courses for you.

Simple Learner Experiences

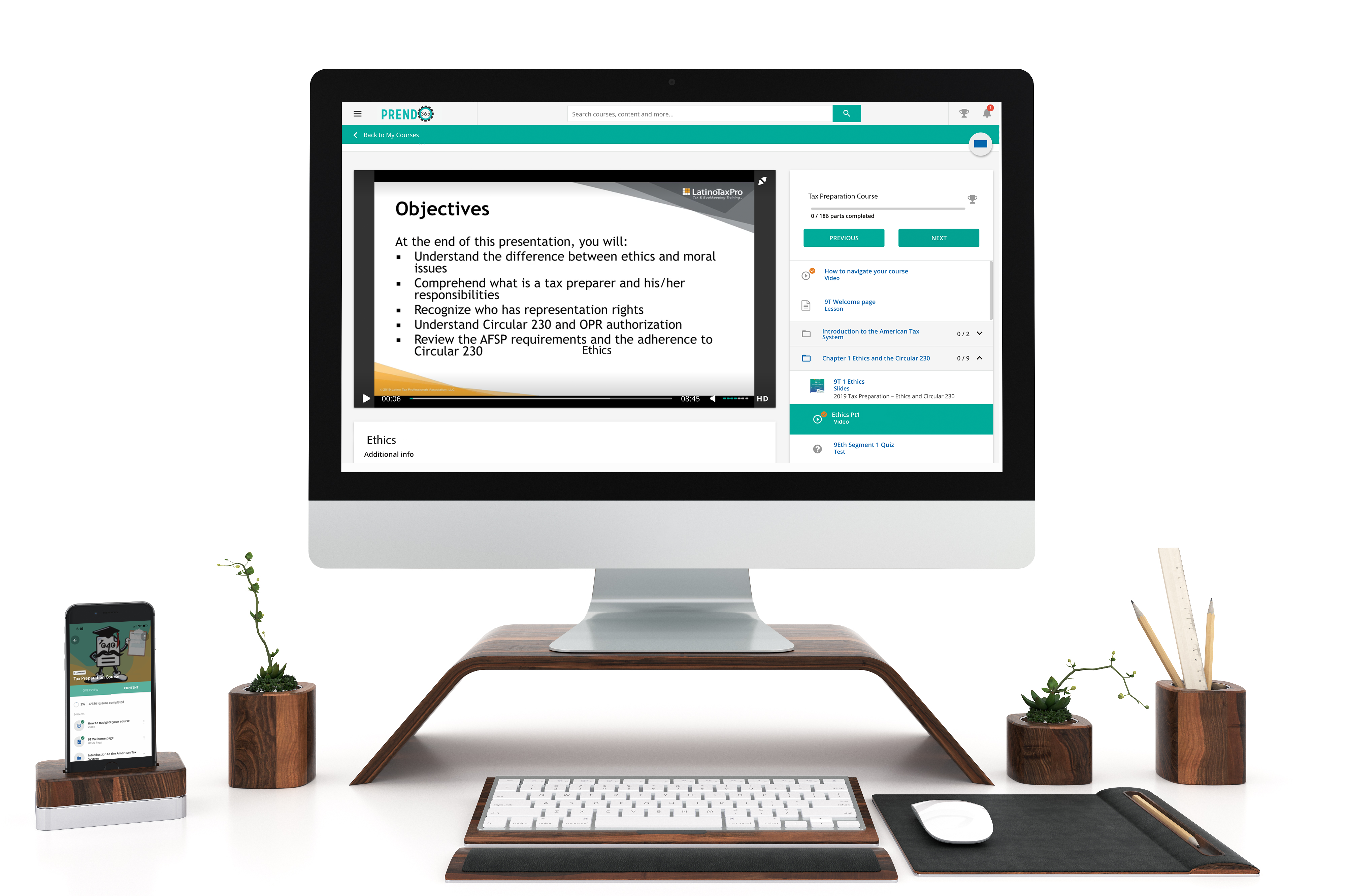

Prendo365 gives you access to your course anytime, anywhere, on desktop, tablet, or mobile device. You're able to easily navigate through your course and receive your certificate of completion.

Why choose us

Over 35+ years tax preparation experience

We know what tax preparers need to succeed in their office

7+ EA’s and tax preparers on staff

Our team does extensive research to ensure you receive the best education

Bilingual live support

Having technical issues? We're ready to help you get started and complete your course.