Description

This course is designed for California tax professionals who have already completed 10-hours of federal tax law; 2 hours of ethics; and 3 hours of updates. This online self-study course is approved by the California Tax Education Council (2080-CE-0004) and fulfills the 5-hours of California Tax Law requirement. The course is not complete until the student hours have been reported to CTEC.

Topics include California income, business income, overview of 540 Schedule CA, itemized deductions what do you add or subtract from the federal income and other taxes.

Objectives

At the end of this course, the student will be able to do the following:

- Understand how California taxes “worldwide income”.

- Know when military income is taxable.

- Define an income subtraction on 540 Schedule CA.

- Describe an income that is an addition on 540 Schedule CA.

- Explain the difference between California and Federal business income.

Field of Study: California Tax Law

Course Level: Intermediate

Prerequisite: General tax preparation knowledge is required.

Delivery Method: Self-Study

Expiration Date to earn CEs: June 31, 2026.

No Federal hours

2080-CE-0004

Self Study

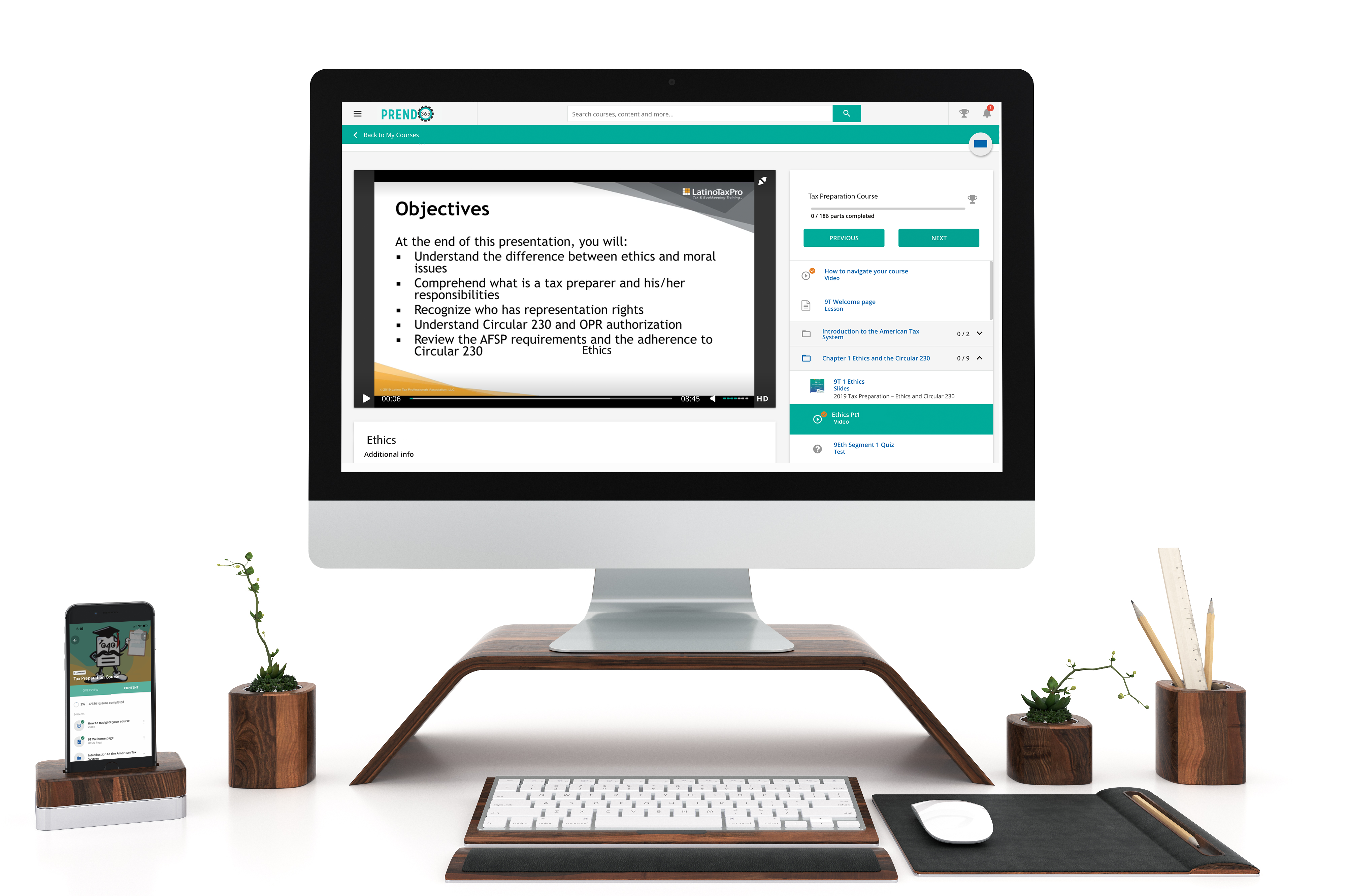

Learn at your own pace, read or watch the lessons, pass the exams.

Mobile Friendly

Learn on your phone, tablet, or computer.

Bilingual

All our courses are available in English y español.

Career Paths

No matter where you’re at in your career, we have courses for you.

Simple Learner Experiences

Prendo365 gives you access to your course anytime, anywhere, on desktop, tablet, or mobile device. You're able to easily navigate through your course and receive your certificate of completion.

Why choose us

Over 35+ years tax preparation experience

We know what tax preparers need to succeed in their office

7+ EA’s and tax preparers on staff

Our team does extensive research to ensure you receive the best education

Bilingual live support

Having technical issues? We're ready to help you get started and complete your course.