Description

The Kiddie Tax Course is an intermediate-level course designed for professional tax preparers seeking a comprehensive understanding of the federal tax on a child’s unearned income. This 1-hour Continuing Education course covers the purpose and practical application of the Kiddie Tax, plus updates for the 2025 tax year. Participants will learn how to identify clients subject to the Kiddie Tax, accurately calculate and report the tax, and advise families on planning strategies to minimize its impact. The course includes detailed guidance on Forms 8615 and 8814, real-world calculation examples, and compliance documentation requirements.

Once a participant has completed the required final, LTP will be notified electronically and will have 72 business hours to upload their CE credits.

Objectives

Upon completion, participants will be able to:

- Explain the purpose of the Kiddie Tax.

- Identify which taxpayers are subject to the Kiddie Tax, including age and support tests.

- Distinguish between earned and unearned income for Kiddie Tax purposes.

- Apply current-year thresholds and calculate Kiddie Tax liability using Forms 8615 and 8814.

- Maintain proper documentation and comply with IRS reporting requirements.

- Develop strategies to minimize the impact of the Kiddie Tax.

Course Details

- Field of Study

- Federal Tax Law

- Credits

- 1.0 CE (1 hour)

- Course Level

- Intermediate

- Prerequisite

- None

- Delivery Method

- Self-Study

- CE Reporting

- LTP uploads CE within 72 business hours after final completion.

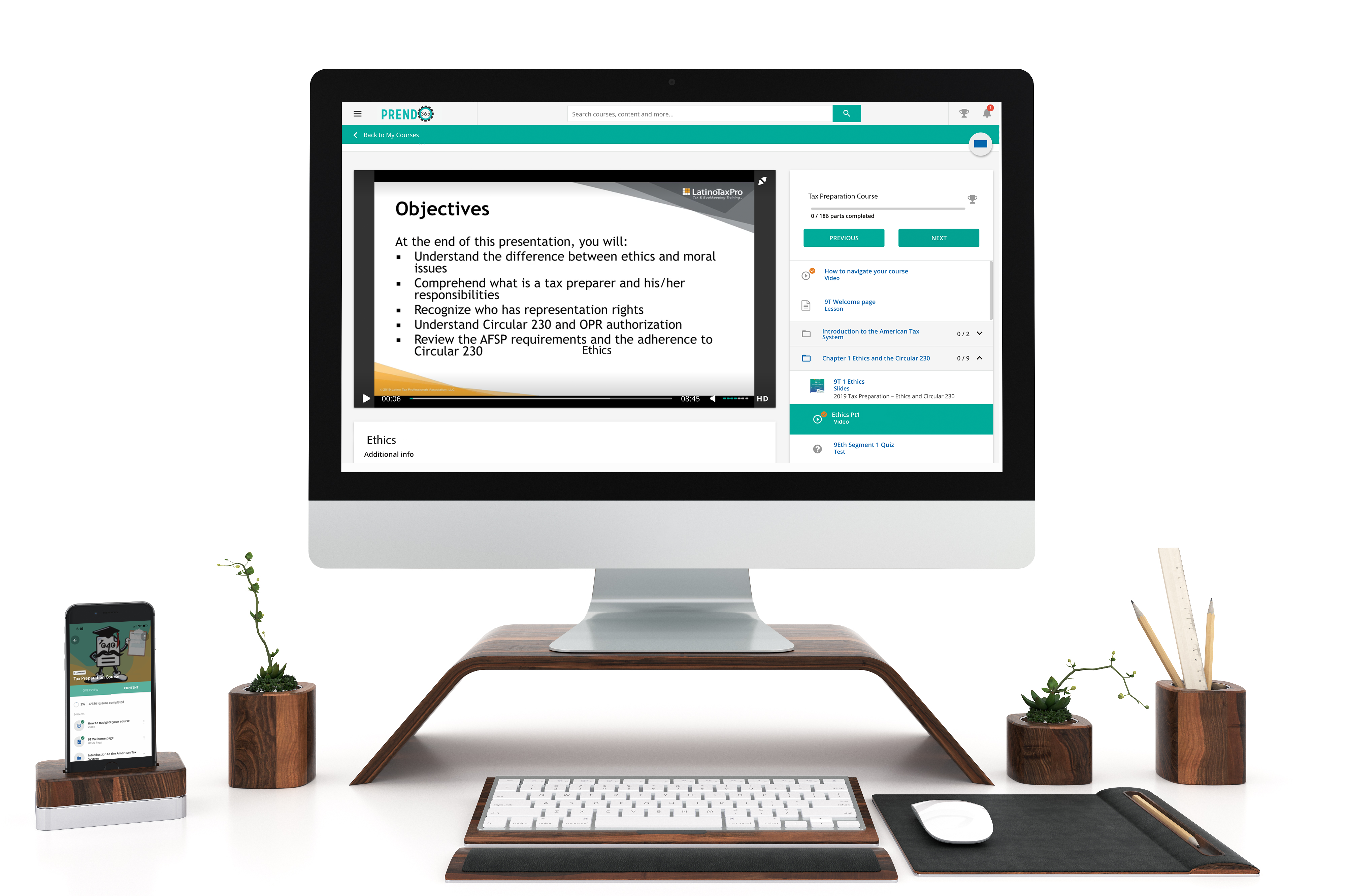

Self Study

Learn at your own pace, read or watch the lessons, pass the exams.

Mobile Friendly

Learn on your phone, tablet, or computer.

Bilingual

All our courses are available in English y español.

Career Paths

No matter where you’re at in your career, we have courses for you.

Simple Learner Experiences

Prendo365 gives you access to your course anytime, anywhere, on desktop, tablet, or mobile device. You're able to easily navigate through your course and receive your certificate of completion.

Why choose us

Over 35+ years tax preparation experience

We know what tax preparers need to succeed in their office

7+ EA’s and tax preparers on staff

Our team does extensive research to ensure you receive the best education

Bilingual live support

Having technical issues? We're ready to help you get started and complete your course.