Electronic filing (also referred to as E-File and E-filing) is the process of submitting tax returns over the internet via properly certified tax software. The E-File system has made tax preparation significantly easier, and the IRS notifies software users within 24-48 hours if they accepted or rejected the tax return. E-filing is not available year-round but rather begins sometime in January and ends sometime in October; the IRS determines when exactly e-filing begins and ends each year, and states follow whatever dates the IRS sets. An electronic return originator (ERO) is the individual who originates the electronic submission of the tax return. To file a return electronically, the individual needs to be an Authorized IRS e-File Provider.

At the end of this course, the student will be able to do the following:

- Understand the different e-filing options.

- Know which form(s) to use when the taxpayer opts out of e-filing.

- Identify which forms are unable to be e-Filed.

Field of Study: Federal Tax Law 2 Hour

Course Level: Intermediate

Prerequisite: General tax preparation knowledge is required

Delivery Method: Self-Study

Self Study

Learn at your own pace, read or watch the lessons, pass the exams.

Mobile Friendly

Learn on your phone, tablet, or computer.

Bilingual

All our courses are available in English y español.

Career Paths

No matter where you’re at in your career, we have courses for you.

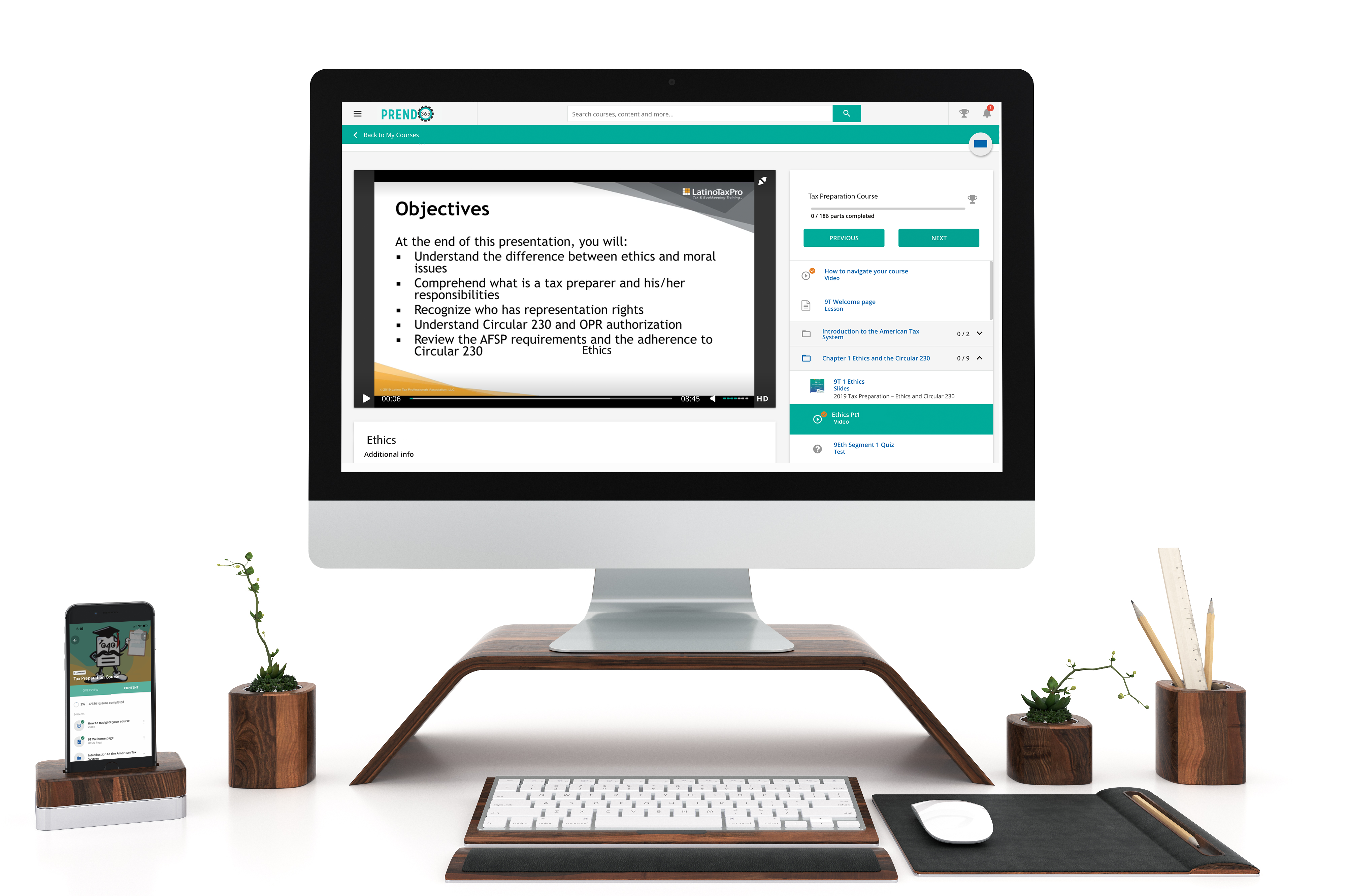

Simple Learner Experiences

Prendo365 gives you access to your course anytime, anywhere, on desktop, tablet, or mobile device. You're able to easily navigate through your course and receive your certificate of completion.

Why choose us

Over 35+ years tax preparation experience

We know what tax preparers need to succeed in their office

7+ EA’s and tax preparers on staff

Our team does extensive research to ensure you receive the best education

Bilingual live support

Having technical issues? We're ready to help you get started and complete your course.