This course qualifies for 15 hours of California tax law for those who have prepared returns from another state and have moved to California and will prepare California tax returns. A completed “Experience in Lieu of Education” needs to be submitted to CTEC and the application can be found on the CTEC website. This course will discuss the differences between the state and the federal tax laws, as well as what California conforms to.

2080-CA-0211

Self Study

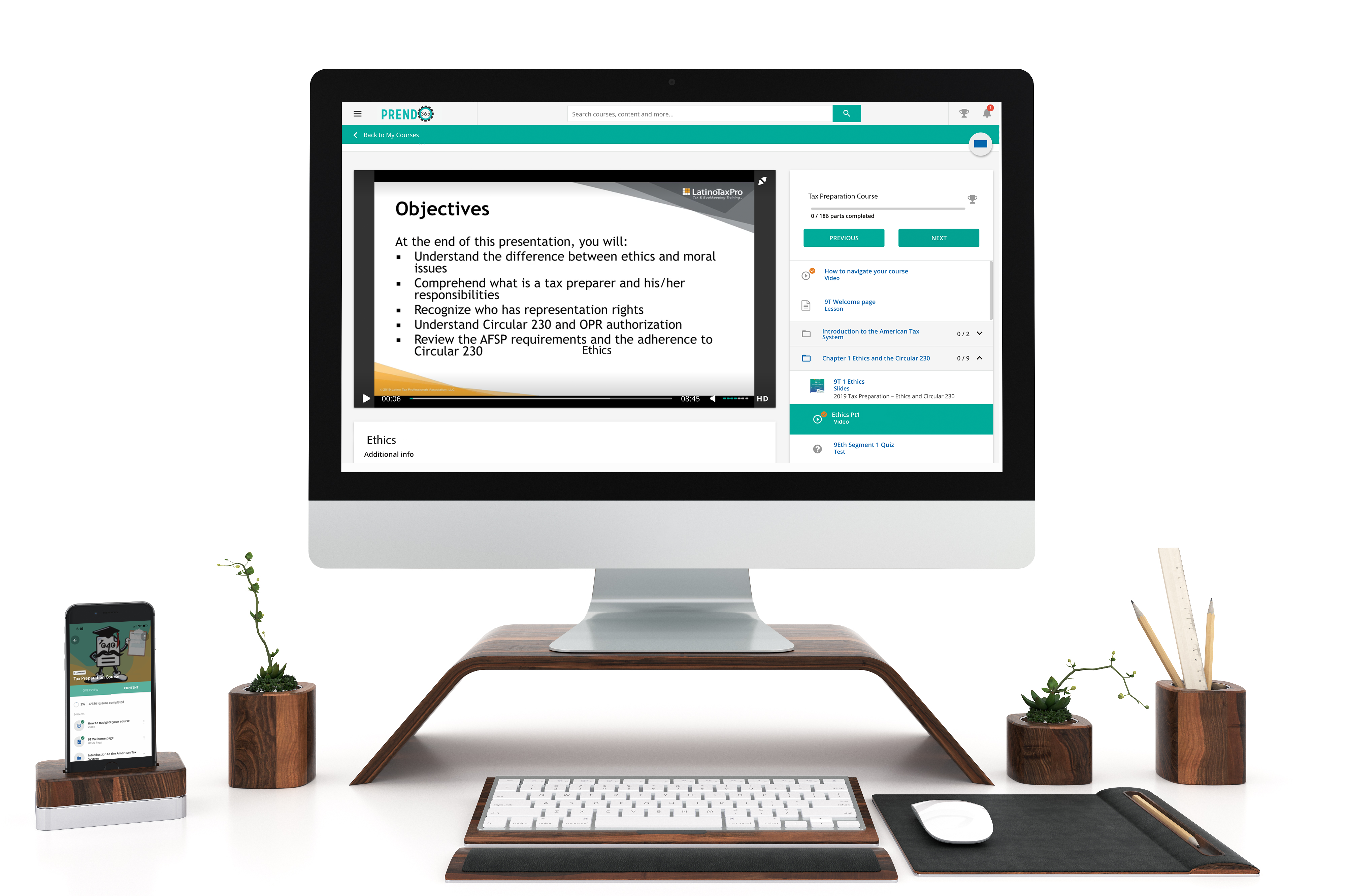

Learn at your own pace, read or watch the lessons, pass the exams.

Mobile Friendly

Learn on your phone, tablet, or computer.

Bilingual

All our courses are available in English y español.

Career Paths

No matter where you’re at in your career, we have courses for you.

Simple Learner Experiences

Prendo365 gives you access to your course anytime, anywhere, on desktop, tablet, or mobile device. You're able to easily navigate through your course and receive your certificate of completion.

Why choose us

Over 35+ years tax preparation experience

We know what tax preparers need to succeed in their office

7+ EA’s and tax preparers on staff

Our team does extensive research to ensure you receive the best education

Bilingual live support

Having technical issues? We're ready to help you get started and complete your course.