This course contains both English and Spanish content.

If taxpayers are unable to file their federal individual tax returns by the due date, he or she may be able to qualify for an automatic six-month extension of time to file. The taxpayer can either electronically file or mail Form 4868 to the IRS to file for the extension. If the taxpayer has filed a return and realizes that a mistake was made, he or she would file an amended return by using Form 1040X.

At the end of this course, the student will be able to do the following:

- Understand when an amendment must be filed.

- Realize when to use Form 4868.

- Identify when the installment agreement should be used.

Field of Study: Federal Tax Law 1 Hour

Course Level: Intermediate

Prerequisite: General tax preparation knowledge is required

Delivery Method: Self-Study

IRS CE: 15G0B-T-00456-20-S

CTEC: 2080-CE-0169

Self Study

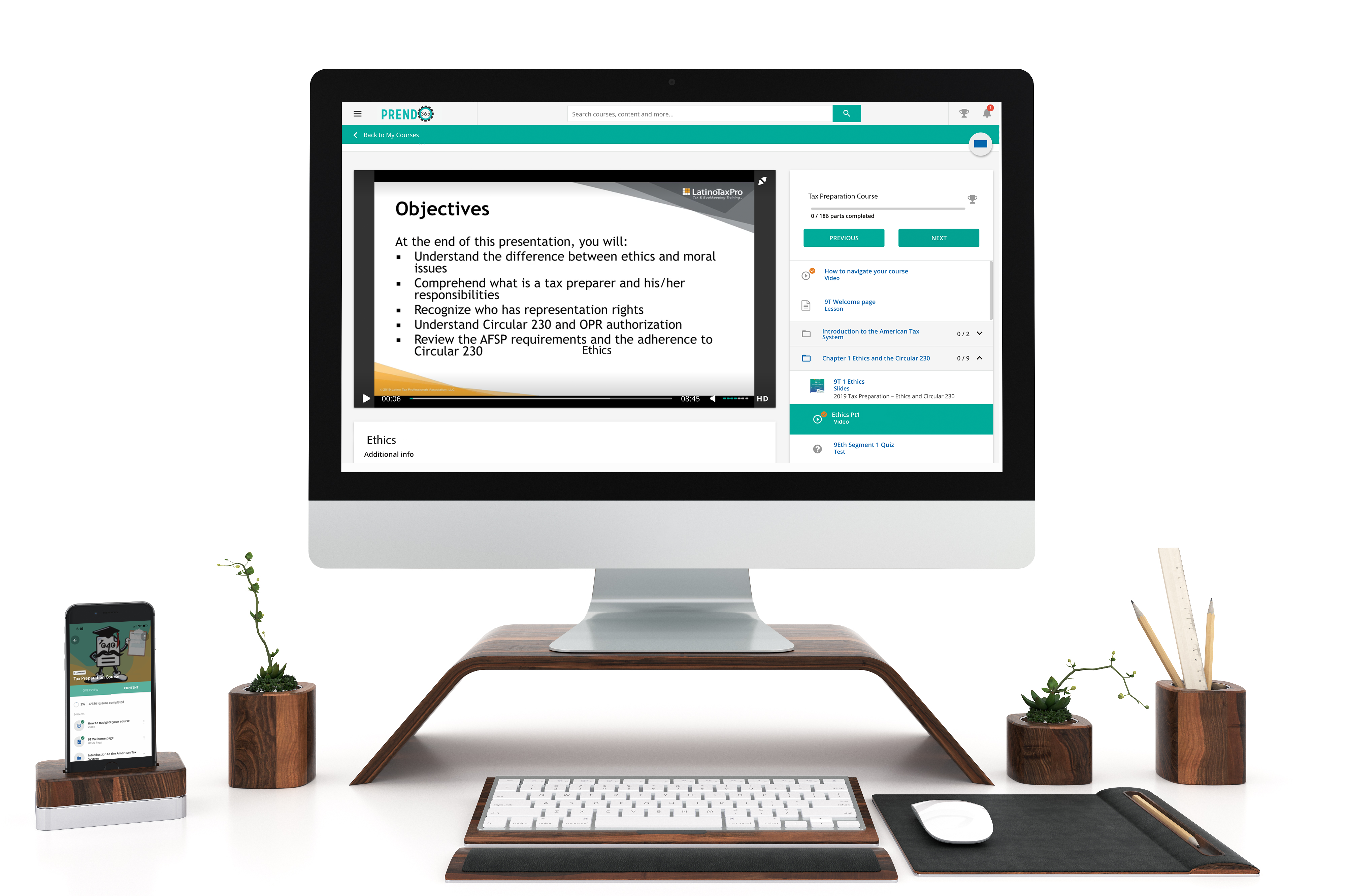

Learn at your own pace, read or watch the lessons, pass the exams.

Mobile Friendly

Learn on your phone, tablet, or computer.

Bilingual

All our courses are available in English y español.

Career Paths

No matter where you’re at in your career, we have courses for you.

Simple Learner Experiences

Prendo365 gives you access to your course anytime, anywhere, on desktop, tablet, or mobile device. You're able to easily navigate through your course and receive your certificate of completion.

Why choose us

Over 35+ years tax preparation experience

We know what tax preparers need to succeed in their office

7+ EA’s and tax preparers on staff

Our team does extensive research to ensure you receive the best education

Bilingual live support

Having technical issues? We're ready to help you get started and complete your course.