The tax preparer will learn how to collect taxpayer’s information needed to prepare an accurate tax return. This course will give detailed interviewing example questions to understand how to collect the necessary information. Completing an interview to gather taxpayer’s information to understand the taxpayer’s situation to prepare an accurate tax return is an essential step.

Sample questions are provided for each section of the tax return to help the student understand the importance of knowing the “how” to and “why” ask questions to gain the necessary information from the taxpayer.

At the end of this course, the student will be able to do the following:

- Identify the different segments of Form 1040.

- Recognize the general items from each section.

- Understand the information needed to file a correct tax return.

- Learn sample questions for each section to build interviewing skills.

Field of Study: Federal Tax Law 2 Hours

Course Level: Basic to intermediate

Prerequisite: General tax preparation knowledge is required

Delivery Method: Self-Study

Self Study

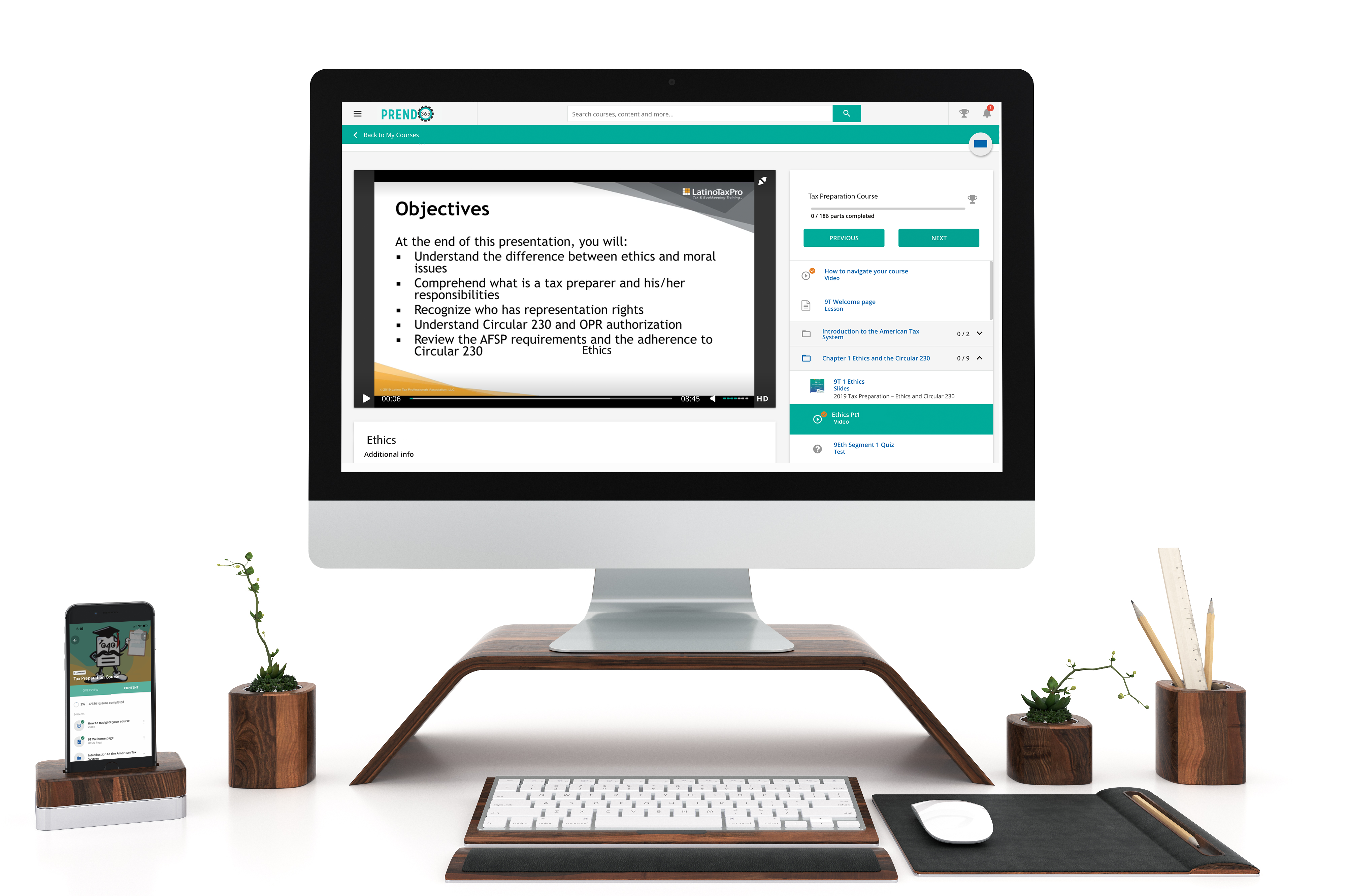

Learn at your own pace, read or watch the lessons, pass the exams.

Mobile Friendly

Learn on your phone, tablet, or computer.

Bilingual

All our courses are available in English y español.

Career Paths

No matter where you’re at in your career, we have courses for you.

Simple Learner Experiences

Prendo365 gives you access to your course anytime, anywhere, on desktop, tablet, or mobile device. You're able to easily navigate through your course and receive your certificate of completion.

Why choose us

Over 35+ years tax preparation experience

We know what tax preparers need to succeed in their office

7+ EA’s and tax preparers on staff

Our team does extensive research to ensure you receive the best education

Bilingual live support

Having technical issues? We're ready to help you get started and complete your course.