Schedule E tax is used by taxpayers in the United States to report Supplemental Income and Loss from rental real estate, royalties, partnerships, S corporations, estates, trusts, and residual interests in real estate mortgage investment conduits (REMICs).

Taxpayers use Schedule E to report rental income and deduct allowable expenses related to operating the rental properties, such as mortgage interest, property taxes, maintenance costs, and depreciation, to calculate their net rental profit or loss for the tax year. This net amount is then transferred to their individual income tax return (Form 1040).

In addition to reporting rental real estate income and expenses, Schedule E is also used to report income or losses from partnerships, estates, trusts, and S-corporations.

Capital gains and losses refer to the increase or decrease in the value of an asset, such as stocks, bonds, real estate, or other investments, over the period of time that the asset is owned. A capital gain occurs when an asset is sold for a higher price than its original purchase price, resulting in a profit. A capital loss occurs when an asset is sold for a lower price than its original purchase price, resulting in a loss.

Understanding capital gains and losses is important for investors as they have tax implications. Capital gains are generally taxed as income, while capital losses can be used to offset other capital gains.

Objectives

At the end of this lesson, the student will:

- Know the types of income reported on Schedule E

- Understand the difference between repairs and improvements

- Know where to find the rental property depreciation chart

- Know the holding periods for different types of property

- Understand the difference between short-term and long-term capital gains

- Be able to identify capital assets

- Know how to determine basis before selling an asset

- Understand when the primary residence is excluded from capital gain

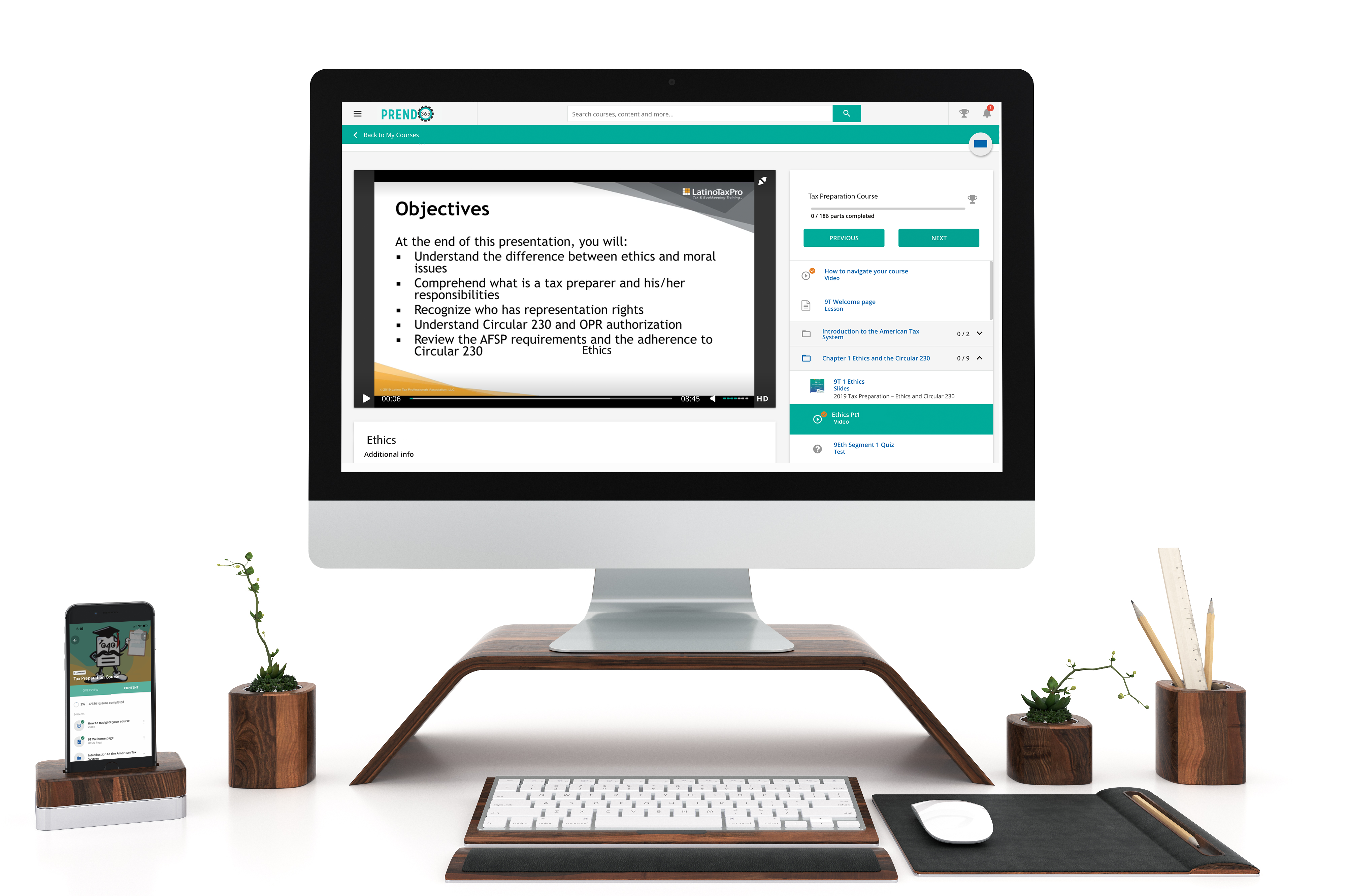

Self Study

Learn at your own pace, read or watch the lessons, pass the exams.

Mobile Friendly

Learn on your phone, tablet, or computer.

Bilingual

All our courses are available in English y español.

Career Paths

No matter where you’re at in your career, we have courses for you.

Simple Learner Experiences

Prendo365 gives you access to your course anytime, anywhere, on desktop, tablet, or mobile device. You're able to easily navigate through your course and receive your certificate of completion.

Why choose us

Over 35+ years tax preparation experience

We know what tax preparers need to succeed in their office

7+ EA’s and tax preparers on staff

Our team does extensive research to ensure you receive the best education

Bilingual live support

Having technical issues? We're ready to help you get started and complete your course.