Description

This course meets the 2025 60-hour qualifying education requirement imposed by the state of California to become a tax preparer. This course has been approved by the California Tax Education Council Vendor #2080.

CTEC requires the student to take a separate test for the following parts: Ethics, Federal Tax Law and California Tax Law. The ethics final consists of 10 questions. California Tax Law final will consist of 75 questions. Federal final will consist of 215 questions. Each final meets CTEC requirement of 5 questions per study hour. All quizzes and finals are taken online.

After certain chapters, the student will complete a Practice Tax Return (PTR). PTR’s have their own review questions. Each PTR is based on what the course has covered.

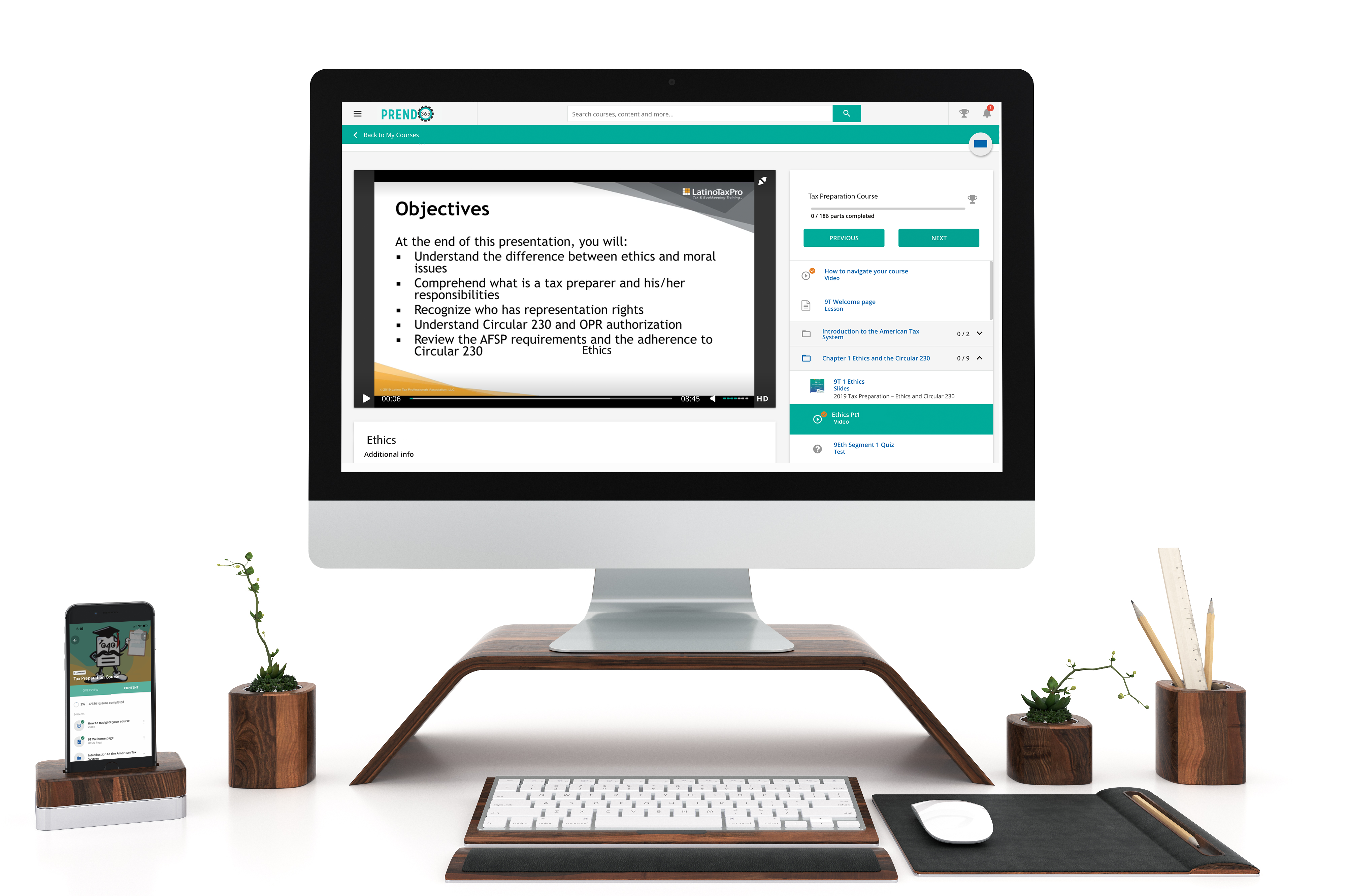

Objectives

At the end of this course, the student will be able to do the following:

- Understand who is a CRTP.

- Comprehend what questions need to be asked to determine the taxpayers filing status.

- Recognize what limited representation means.

- Understand limited representation rights.

- Understand the meaning of “worldwide income”.

Field of Study: Federal Tax Law, Ethics and California Tax Law

Course Level: Basic

Prerequisite: None

Delivery Method: Self-Study

Expiration Date to earn CEs: June 31, 2026.

No Federal CE Hours for this course.

2080-QE-0001

As of November 1, 2021,

- Last Name and Last Six Digits of SSN are no longer being used to report qualifying education. In order to report your hours, you must have a CTEC ID. Please reply with your CTEC ID to edsupport@latinotaxpro.com to report your hours.

Self Study

Learn at your own pace, read or watch the lessons, pass the exams.

Mobile Friendly

Learn on your phone, tablet, or computer.

Bilingual

All our courses are available in English y español.

Career Paths

No matter where you’re at in your career, we have courses for you.

Simple Learner Experiences

Prendo365 gives you access to your course anytime, anywhere, on desktop, tablet, or mobile device. You're able to easily navigate through your course and receive your certificate of completion.

Why choose us

Over 35+ years tax preparation experience

We know what tax preparers need to succeed in their office

7+ EA’s and tax preparers on staff

Our team does extensive research to ensure you receive the best education

Bilingual live support

Having technical issues? We're ready to help you get started and complete your course.