CTEC requires that the CRTP renew their registration yearly by October 31st. If the student does not complete their continuing education by the late renewal of January 15 of the following year, they will need to retake the 60-hour course, get a background check, and be fingerprinted.

The 2025 CTEC 20 Hour Continuing Education renewal course fulfills the 20-hour CTEC requirement for CRTPs who have already completed 60 hours of Qualifying Education.

This course is divided into four parts: Ethics, Federal Tax Law, Updates, and California Tax Law. Each part contains a final; the final must be passed with a 70% or higher.

At the end of this course, the student will be able to do the following:

- Understand limited representation rights.

- Recognize the annual inflation rates for the standard deduction.

- Comprehend Section 199 limits.

- Identify taxpayers who qualify for Casualty and Theft Loss deductions.

- Know the penalty amount per refundable credit.

- Recognize the annual inflation rates for the standard deduction.

Click on a chapter title to view the content description

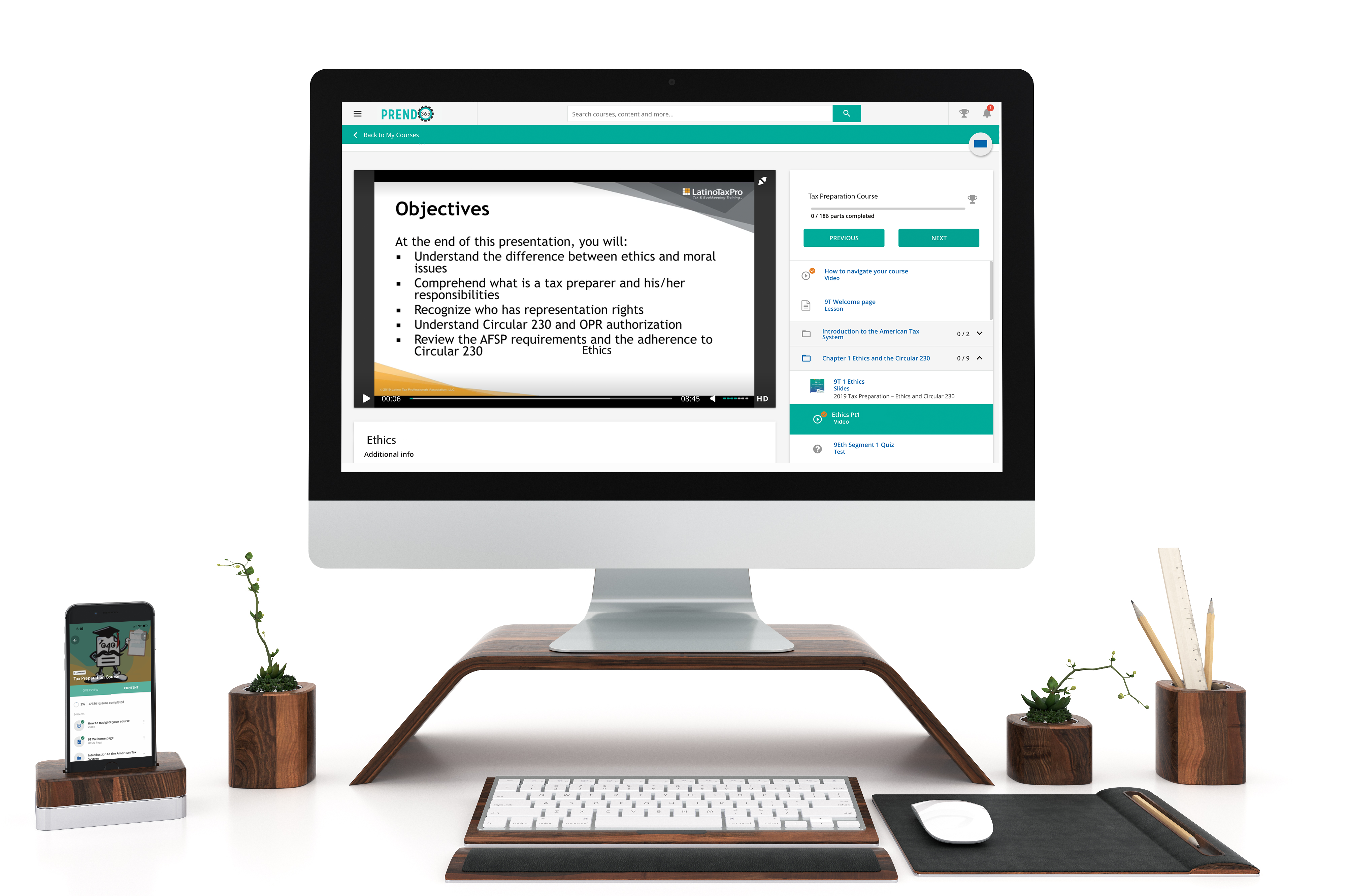

Part 1 Ethics and Preparer Penalties

This chapter will explain how to determine who qualifies as a tax return preparer, what representation rights a preparer has, how that individual is bound by the Circular 230 guidelines, and what it means for a tax preparer to behave ethically and responsibly.

Part 2 Federal Tax Law

Compiling Taxpayer's Information

The tax preparer will learn how to collect the necessary information to prepare an accurate tax return. This course will provide detailed interviewing example questions to help the preparer understand how to collect the necessary information. Completing an interview to gather the necessary information to understand the taxpayer’s situation is an essential step.

Sample questions are provided for each section of the tax return to help the student understand the importance of knowing “how” and “why” to ask questions to obtain the necessary information from the taxpayer.

Schedule C

This course encompasses how the sole proprietor reports income. The sole proprietorship is the most popular business structure. It is indistinguishable from its owner, and all income earned is reported by the owner. Schedule C is the reporting tool for most sole proprietors. The course covers line-by-line instruction on completing Schedule C.

Schedule F and Depreciation

Income received from the operation of a farm or from rental income from a farm is taxable. Farmers determine their taxable income from farming and related activities by using Schedule F. Profit or loss from farm income is first reported on Schedule F and then “flows” to Form 1040, Schedule 1, line 6. This course covers basic farm income and expenses.

Depreciation is an annual deduction that allows taxpayers to recover the cost or other basis of their business or investment property over a certain number of years. Depreciation is an allowance for the wear and tear, decline, or uselessness of a property and begins when a taxpayer places property in service for use in a trade or business. The property ceases to be depreciable when the taxpayer has fully recovered the property’s cost or other basis or when the property has been retired from service, whichever comes first. Depreciation is reported on Form 4562.

Part 3 California Tax Law

California Compiling Taxpayer's Information

This chapter outlines the key differences between California and federal tax returns, emphasizing that the California tax return does not follow a line-by-line format of the federal return. It highlights how California subtracts the exemption amount from the tax owed and does not conform to the Tax Cuts and Jobs Act regarding dependent exemptions. The chapter also details the necessary personal information for completing the state return, especially for registered domestic partners and same-sex married couples. By the end of the lesson, students will understand the differences in personal exemptions, filing statuses, and specific requirements for preparing a California tax return compared to the federal return.

California Schedule C

This chapter explores the differences between federal and California tax laws regarding business income, mainly focusing on self-employment income. It highlights the implications of self-employment tax and addresses withholding issues for self-employed nonresidents. The chapter also clarifies the distinctions between common law employees, statutory employees, and independent contractors. By the end of the lesson, students will understand how California treats self-employment income and be able to identify who qualifies as a statutory employee. Additionally, they will recognize the reporting requirements for independent contractors, which are essential for compliant tax practices in California.

California Schedule E and Capital Gains and Losses

This chapter provides an overview of the key differences between federal and California tax laws regarding rental property. It highlights how California conforms to the Internal Revenue Code concerning passive activity loss yet differs significantly in its treatment of rental real estate activities and depreciation. Additionally, the chapter covers the implications of basis differences and the necessary adjustments for filing state tax returns. By the end of the lesson, students will understand California's approach to rental properties, including substandard rentals, passive activity loss characterization, and the treatment of capital gains and losses.

California Schedule F and Depreciation

This chapter examines California's treatment of business income regarding Schedule F, which aligns closely with Schedule C under federal law. It highlights California's general conformity to the Internal Revenue Code as of January 1, 2015, while emphasizing critical differences in depreciation methods, notable credits, and accelerated write-offs. The chapter also discusses specific instances of nonconformity related to various tax credits and depreciation rules, including the Inflation Reduction Act and the Job Creation and Worker Assistance Act. By the end of the lesson, students will understand the conformity and nonconformity between California and federal tax laws regarding farm income, expenses, and asset depreciation.

Part 4 Tax Updates

2025 brings numerous changes to the tax code. This course will give you the most current updates available, based on information released by the IRS, that you'll need to prepare the 2025 tax return in 2026. From revised deductions and credits to new reporting requirements, these updates will impact the preparation of individual and business returns.

Some of the topics covered are the latest updates for the SECURE. Act and major changes regarding the inherited IRAs disbursement. Standard mileage rates have been adjusted, necessitating careful calculations for business, medical, and moving-related mileage expenses. The standard deduction has increased, requiring updated calculations, software and worksheets.

end

To renew your registration all CRTPs must...

- Complete 20 hours (10 hours federal tax law, 3 hours federal tax update, 2 hours of ethics and 5 hours for California tax law) of continuing tax education each year

- Maintain a valid PTIN from the IRS

- Maintain a $5,000 tax preparer bond

- Renew the registration by October 31st of each year with a $33 fee

- If the deadline is missed, complete your late renewal by January 15 with an additional $55 late fee.

|

Course Details |

Included in this course |

|

CTEC Vendor #: 2080 To earn certificate of completion: • Pass Final Exams with 70% (or better) |

• 4-Part eBook |

Self Study

Learn at your own pace, read or watch the lessons, pass the exams.

Mobile Friendly

Learn on your phone, tablet, or computer.

Bilingual

All our courses are available in English y español.

Career Paths

No matter where you’re at in your career, we have courses for you.

Simple Learner Experiences

Prendo365 gives you access to your course anytime, anywhere, on desktop, tablet, or mobile device. You're able to easily navigate through your course and receive your certificate of completion.

Why choose us

Over 35+ years tax preparation experience

We know what tax preparers need to succeed in their office

7+ EA’s and tax preparers on staff

Our team does extensive research to ensure you receive the best education

Bilingual live support

Having technical issues? We're ready to help you get started and complete your course.