Deadline: LTP encourages you to complete this course by December 29th to allow time for reporting credits and any support. The IRS deadline to complete is December 31st, 2025*.

The 2025 Annual Federal Tax Refresher (AFTR) course is intended to prepare the individual for the 2026 filing season. . This course covers the latest tax law changes and current tax issues, as well as practice and professional responsibility. This course follows the 3 domains that are set annually by the IRS. They include:

1: New Tax Law/Recent Updates

2: General Review

3: Practices, Procedures and Professional Responsibility

Objectives

At the end of this course, the student will be able to do the following:

- Understand limited representation rights.

- Recognize the annual inflation rates for the standard deduction.

- Comprehend the difference between business vs hobby.

- Identify taxpayers who qualify for a federally declared disaster area.

This course contains the 100 questions 3-hour time exam and needs to be completed with a score of 70% or better.

Need the full 18 hours of the Annual Filing Season Program? Click here to view our bundle.

*The IRS deadline to complete this course is December 31st at midnight your local time, however, keep in mind our office will be closed on 12/31 at 5 pm PT. Hours that are completed by the IRS deadline will be reported on the following business day.

How to access your course?

First-time users: You will receive an email with the subject line "Welcome to Prendo365 - DO NOT REPLY". This email will contain your username and password. Please check your spam/junk folder if you do not see the email. Prendo365.com is our powerful, user-friendly E-learning system where you can access the eBook, quizzes, practice tax returns, finals, and more!

Returning users: You can access your course on Prendo365.com with the same login credentials as previously used. If you forgot your password, simply click "Forgot your password?" right below the sign-in box on Prendo365.

How do I obtain an AFSP – Record of Completion?

3. Consent to adhere to specific practice obligations outlined in Subpart B and section 10.51 of Treasury Department Circular No. 230.

- Established state-based return preparer program participants currently with testing requirements: Return preparers who are active registrants of the Oregon Board of Tax Practitioners, California Tax Education Council, and/or Maryland State Board of Individual Tax Preparers.

- SEE Part I Test-Passers: Tax practitioners who have passed the Special Enrollment Exam Part I within the past two years.

- VITA/TCE volunteers: Quality reviewers, instructors, and return preparers with active PTINs.

- Other accredited tax-focused credential-holders: The Accreditation Council for Accountancy and Taxation’s Accredited Business Accountant/Advisor (ABA) and Accredited Tax Preparer (ATP) programs.

I meet one of these exemptions. How do I obtain an AFSP – Record of Completion?

- Take fifteen (15) hours of continuing education, including:

- three (3) hours of federal tax law updates,

- ten (10) hours of other federal tax law topics and

- two (2) hours of ethics.

- Have an active preparer tax identification number (PTIN).

- Consent to adhere to specific practice obligations outlined in Subpart B and section 10.51 of Treasury Department Circular No. 230 PDF.

|

Course Details |

Included in this course |

|

To earn certificate of completion: • Pass Final with 70% (or better) |

• eBook |

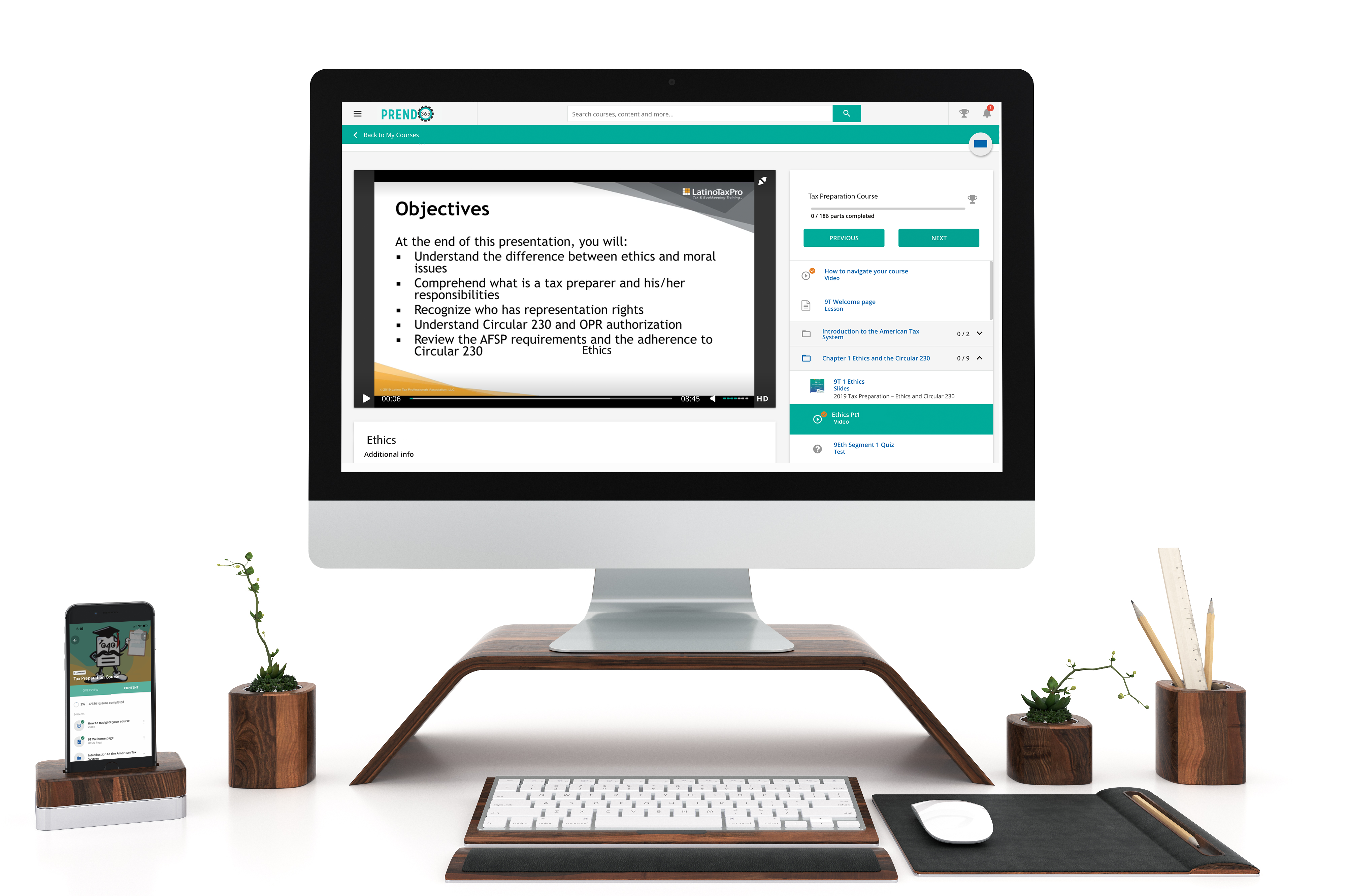

Self Study

Learn at your own pace, read or watch the lessons, pass the exams.

Mobile Friendly

Learn on your phone, tablet, or computer.

Bilingual

All our courses are available in English y español.

Career Paths

No matter where you’re at in your career, we have courses for you.

Simple Learner Experiences

Prendo365 gives you access to your course anytime, anywhere, on desktop, tablet, or mobile device. You're able to easily navigate through your course and receive your certificate of completion.

Why choose us

Over 35+ years tax preparation experience

We know what tax preparers need to succeed in their office

7+ EA’s and tax preparers on staff

Our team does extensive research to ensure you receive the best education

Bilingual live support

Having technical issues? We're ready to help you get started and complete your course.