The 2025 Annual Federal Tax Refresher (AFTR) course is intended to prepare the individual for the 2026 filing season. This course covers the latest tax law changes and current tax issues, as well as practice and professional responsibility. This course follows the 3 domains that are set annually by the IRS. They include:

- New Tax Law/Recent Updates

- General Review

- Practices, Procedures and Professional Responsibility

This course contains the 100 questions 3-hour time exam and needs to be completed with a score of 70% or better.

Need the full 18 hours of the Annual Filing Season Program? Click here to view our bundle.

*The IRS deadline to complete this course is December 31st at midnight your local time, however, keep in mind our office will be closed on 12/31. Hours that are completed by the IRS deadline will be reported on the following business day.

How do I obtain an AFSP – Record of Completion?

3. Consent to adhere to specific practice obligations outlined in Subpart B and section 10.51 of Treasury Department Circular No. 230.

- Anyone who passed the Registered Tax Return Preparer test administered by the IRS between November 2011 and January 2013.

- Established state-based return preparer program participants currently with testing requirements: Return preparers who are active registrants of the Oregon Board of Tax Practitioners, California Tax Education Council, and/or Maryland State Board of Individual Tax Preparers.

- SEE Part I Test-Passers: Tax practitioners who have passed the Special Enrollment Exam Part I within the past two years.

- VITA/TCE volunteers: Quality reviewers, instructors, and return preparers with active PTINs.

- Other accredited tax-focused credential-holders: The Accreditation Council for Accountancy and Taxation’s Accredited Business Accountant/Advisor (ABA) and Accredited Tax Preparer (ATP) programs.

I meet one of these exemptions. How do I obtain an AFSP – Record of Completion?

- Take fifteen (15) hours of continuing education, including:

- three (3) hours of federal tax law updates,

- ten (10) hours of other federal tax law topics and

- two (2) hours of ethics.

- Have an active preparer tax identification number (PTIN).

- Consent to adhere to specific practice obligations outlined in Subpart B and section 10.51 of Treasury Department Circular No. 230 PDF.

--------------------------------------------------------------

Créditos de Educación Continua (CE, por sus siglas en inglés): 6 AFTR

Fecha límite: LTP le recomienda completar este curso antes del 29 de diciembre para dar tiempo a reportar los créditos y cualquier apoyo. La fecha límite del IRS para completar es el 31 de diciembre*.

El curso 2025 Actualización anual de impuestos federales (AFTR) tiene la intención de preparar a la persona para el próximo año tributario. Este curso cubre los últimos cambios en la legislación tributaria y los problemas tributarios actuales, así como la práctica y la responsabilidad profesional. Cuando el profesional de impuestos no inscrito aprueba este curso con un 70% o más y completa 10 horas de ley tributaria y 2 horas de ética, podría calificar para estar en la base de datos nacional del IRS. Este curso sigue los 3 dominios que se establecen anualmente por el IRS. Entre ellos se incluyen:

- Nueva Ley Tributaria/Actualizaciones Recientes

- Revisión general

- Prácticas, Procedimientos y Responsabilidad Profesional

* La fecha límite del IRS para completar es el 31 de diciembre a la medianoche de su hora local, sin embargo, tenga en cuenta que nuestra oficina estara cerrada 12/31. Las horas que se completen antes de la fecha límite del IRS se informarán el siguiente día hábil.

¿Cómo acceder a su curso?

Usuario de primera vez: Recibirás un correo electrónico de edsupport@latinotaxpro.com con el asunto "Welcome to Prendo365". Este correo electrónico contendrá su nombre de usuario y contraseña. Por favor, revise su carpeta de spam / junk si no ve el correo electrónico. Prendo365.com es nuestro sistema de aprendizaje electrónico potente y fácil de usar donde puede acceder el libro electrónico, cuestionarios, practicar declaraciones de impuestos, finales y más.

Usuarios que regresan: Puede acceder a su curso en Prendo365.com con las mismas credenciales de inicio de sesión que se usaron anteriormente. Si olvidó su contraseña, simplemente haga clic en "Forgot your password?" justo debajo del cuadro de inicio de sesión en Prendo365.

¿Cómo obtengo un registro de finalización del AFSP?

1. Obtenga 18 horas de educación continua de proveedores de CE aprobados por el IRS, que incluyen:

- un curso de Actualización Anual de Impuestos Federales (AFTR) de seis (6) horas que cubre temas de la temporada de declaración y actualizaciones de la legislación fiscal, así como una prueba de comprensión basada en el conocimiento realizada al final del curso por el proveedor de CE;

- diez (10) horas de otros temas de la Ley de Impuesto Federal; y

- dos (2) horas de Ética.

2. Tener un número de identificación fiscal del preparador (PTIN) activo.

3. Dar su consentimiento para cumplir con las obligaciones prácticas específicas descritas en la subsección B y la sección 10.51 de la Circular del Departamento del Tesoro No. 230.

¿Quién está exento y puede obtener el registro de finalización del AFSP sin tomar el curso de Actualización Anual de Impuestos Federales?

- Cualquier persona que haya aprobado el examen de Preparador Registrado de Declaraciones de Impuestos administrado por el IRS entre noviembre de 2011 y enero de 2013.

- Participantes del programa de preparador de declaraciones establecidas basado en el estado actualmente con requerimientos de pruebas: Preparadores de declaraciones que son registrantes activos de la Junta de Profesionales de Impuestos de Oregón, el Consejo de Educación Tributaria de California y/o la Junta de Preparadores de Impuestos de Personas Naturales del Estado de Maryland.

- CONSULTE la Parte I Aprobación de exámenes: Profesionales de impuestos que han aprobado la Parte I del examen de inscripción especial en los últimos dos años.

- Voluntarios VITA/TCE: Revisores de calidad, instructores y preparadores de declaraciones con PTIN activos.

- Otros titulares de credenciales centrados en impuestos que han sido acreditados: El Consejo de Acreditación para Contadores y Asesores/Contadores Comerciales Acreditados (ABA) y los programas de Preparadores de Impuestos Acreditados (ATP).

Cumplo con una de estas exenciones. ¿Cómo obtengo un AFSP – Registro de Finalización?

- Tome quince (15) horas de educación continua, que incluyen:

- tres (3) horas de actualizaciones de la ley tributaria federal,

- diez (10) horas de otros temas de ley tributario federal y

- dos (2) horas de ética.

- Tener un número de identificación fiscal (PTIN) de preparador activo.

- Consentimiento para cumplir con las obligaciones prácticas específicas descritas en la Subparte B y la sección 10.51 de la Circular no. 230 PDF del Departamento del Tesoro.

|

Course Details |

Included in this course |

|

To earn a certificate of completion: • Pass Final with 70% (or better) |

• eBook |

Self Study

Learn at your own pace, read or watch the lessons, pass the exams.

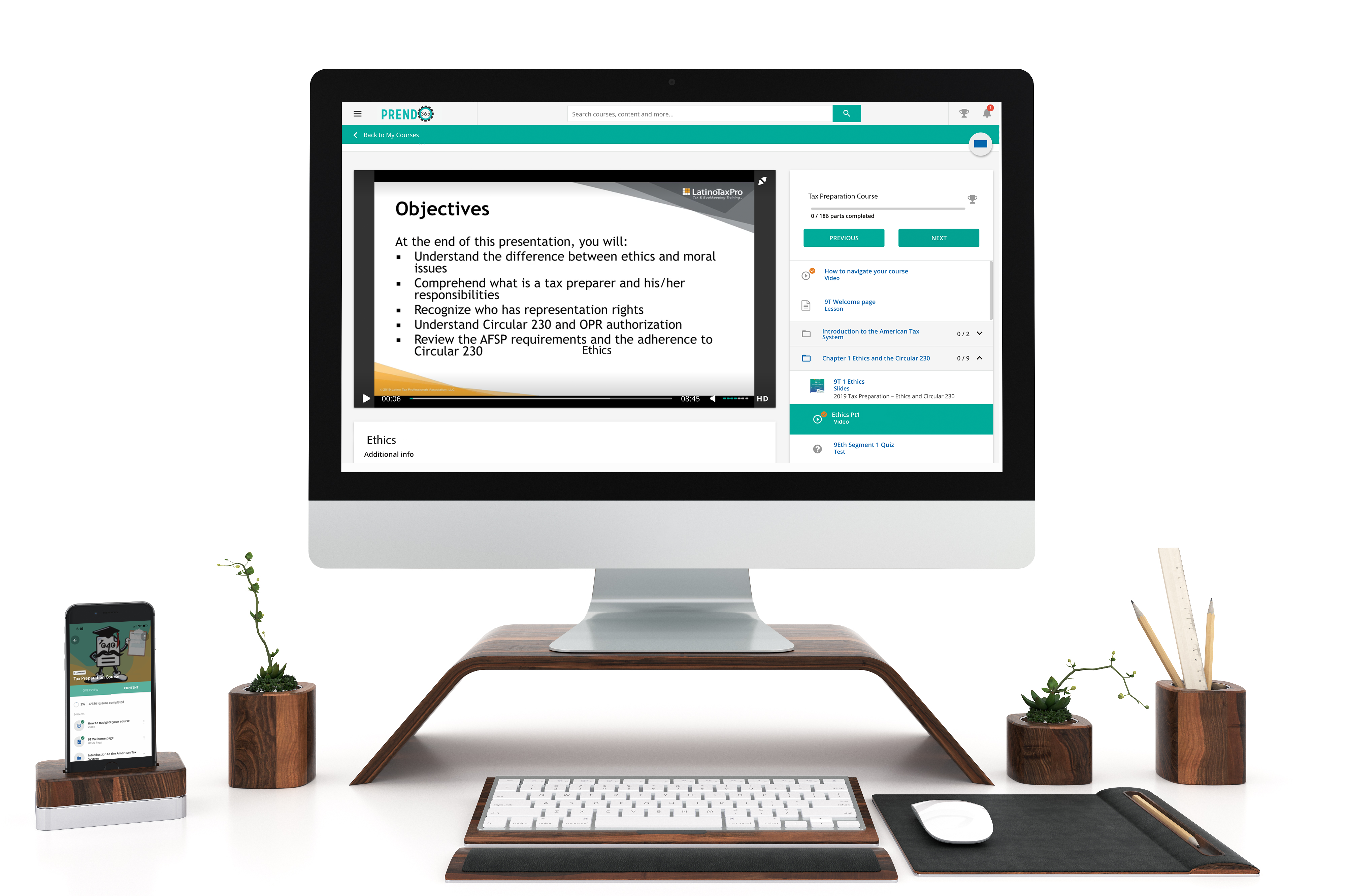

Mobile Friendly

Learn on your phone, tablet, or computer.

Bilingual

All our courses are available in English y español.

Career Paths

No matter where you’re at in your career, we have courses for you.

Simple Learner Experiences

Prendo365 gives you access to your course anytime, anywhere, on desktop, tablet, or mobile device. You're able to easily navigate through your course and receive your certificate of completion.

Why choose us

Over 35+ years tax preparation experience

We know what tax preparers need to succeed in their office

7+ EA’s and tax preparers on staff

Our team does extensive research to ensure you receive the best education

Bilingual live support

Having technical issues? We're ready to help you get started and complete your course.