Description

This course covers the basics of federal tax preparation. The student will learn how the American Tax System began, how to interview the taxpayer to determine what filing status they should use and what tax credits the taxpayer may qualify for.

Objectives

At the end of this course, the student will be able to do the following:

- Explain how a nonrefundable credit affects the taxpayer’s tax liability.

- Recognize what is professional responsibility in tax preparation.

- Realize what the tax preparer’s responsibilities are to the taxpayer.

Field of Study: Federal Tax Law 8 Hours and Behavioral Ethics 2 Hours

Course Level: Basic

Prerequisite: General tax preparation knowledge is required

Delivery Method: Self-Study

Expiration Date to earn CEs: June 31, 2026.

This course does not qualify for California Continuing Education hours

Self Study

Learn at your own pace, read or watch the lessons, pass the exams.

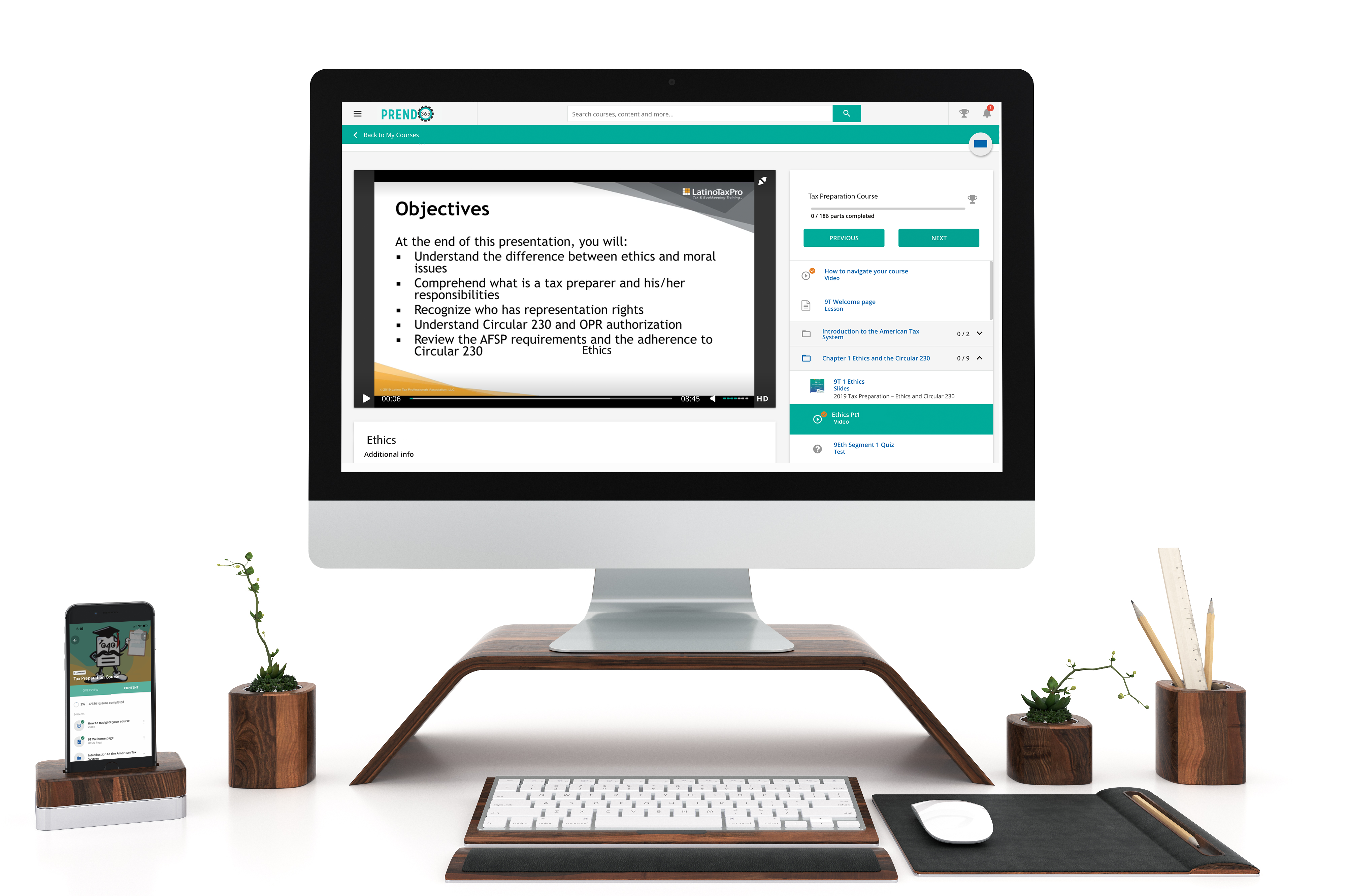

Mobile Friendly

Learn on your phone, tablet, or computer.

Bilingual

All our courses are available in English y español.

Career Paths

No matter where you’re at in your career, we have courses for you.

Simple Learner Experiences

Prendo365 gives you access to your course anytime, anywhere, on desktop, tablet, or mobile device. You're able to easily navigate through your course and receive your certificate of completion.

Why choose us

Over 35+ years tax preparation experience

We know what tax preparers need to succeed in their office

7+ EA’s and tax preparers on staff

Our team does extensive research to ensure you receive the best education

Bilingual live support

Having technical issues? We're ready to help you get started and complete your course.