This course qualifies for 18 hours of continuing education. This course contains 10 hours tax law, 6 hours AFTR, and 2-hours Ethics. After completion of the course with a 70% or better, the tax professional will have limited representation rights for their clients.

To obtain an AFSP-Record of Completion for Filing Season 2026 the following needs to be completed.

- Take a six (6) hour Annual Federal Tax Refresher (AFTR) course that covers filing season issues and tax law updates, as well as a knowledge-based comprehension test administered at the end of the course by the CE Provider.

- Take ten (10) hours of other federal tax law topics.

- Take two (2) hours of ethics.

- Have a current preparer tax identification number (PTIN).

- Consent to adhere to specific practice obligations outlined in subpart B and section 10.51 of Treasury Department Circular No. 230.

A tax preparer needs to have a PTIN account, to receive emails from TaxPro_PTIN@irs.gov with instructions on how to sign the Circular 230 consent and receive your certificate in your online secure mailbox. If you do not have an online PTIN account, you will receive a letter with instructions for completing the application process and obtaining your certificate.

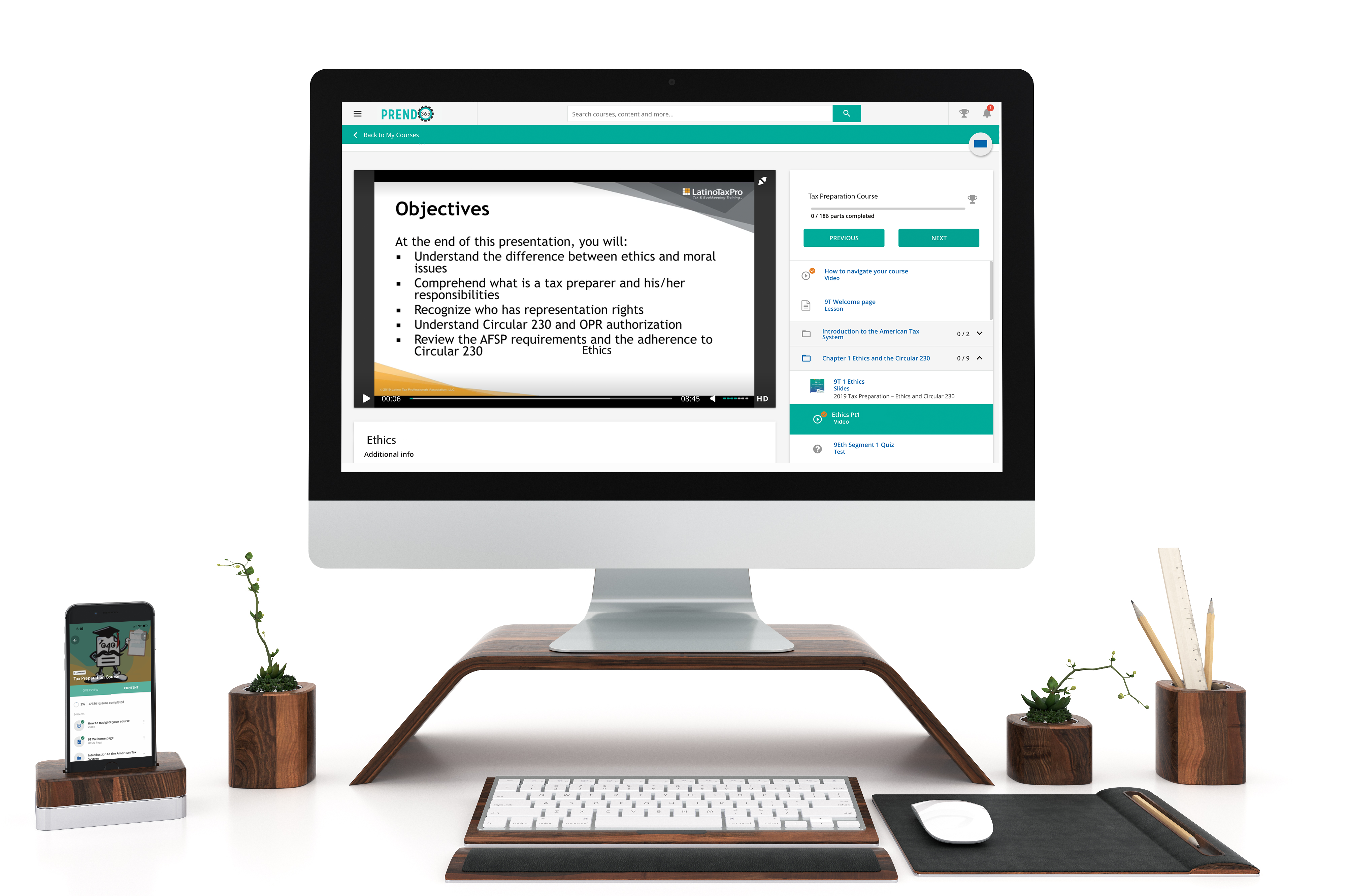

Objectives

At the end of this course, the student will be able to do the following:

- Understand their limited representation rights.

- Know the penalty amount per refundable credit.

- Recognize the annual inflation rates for the standard deduction.

Fields of Study: Federal Tax Law 10 Hours, Behavioral Ethics 2 Hours, and 6 Hour AFTR

Course Level: Intermediate

Prerequisite: General tax preparation knowledge is required.

Delivery Method: Self-Study

Expiration Date to earn all 18 CE credits: December 31, 2025. Midnight local time.

The 6 hours AFTR portion of this course expires on December 31, 2025. You could still complete the 10 hour Federal Tax Law, and the 2-hour Ethics portions of the course for credit after the expiration date.

This course does not qualify for California Continuing Education hours.

*eBook is copyright protected and can't be downloaded.

After 12/31/25 Only 10 hours of Federal Tax Law and 2 of Ethics will be reported per IRS regulations.

Self Study

Learn at your own pace, read or watch the lessons, pass the exams.

Mobile Friendly

Learn on your phone, tablet, or computer.

Bilingual

All our courses are available in English y español.

Career Paths

No matter where you’re at in your career, we have courses for you.

Simple Learner Experiences

Prendo365 gives you access to your course anytime, anywhere, on desktop, tablet, or mobile device. You're able to easily navigate through your course and receive your certificate of completion.

Why choose us

Over 35+ years tax preparation experience

We know what tax preparers need to succeed in their office

7+ EA’s and tax preparers on staff

Our team does extensive research to ensure you receive the best education

Bilingual live support

Having technical issues? We're ready to help you get started and complete your course.